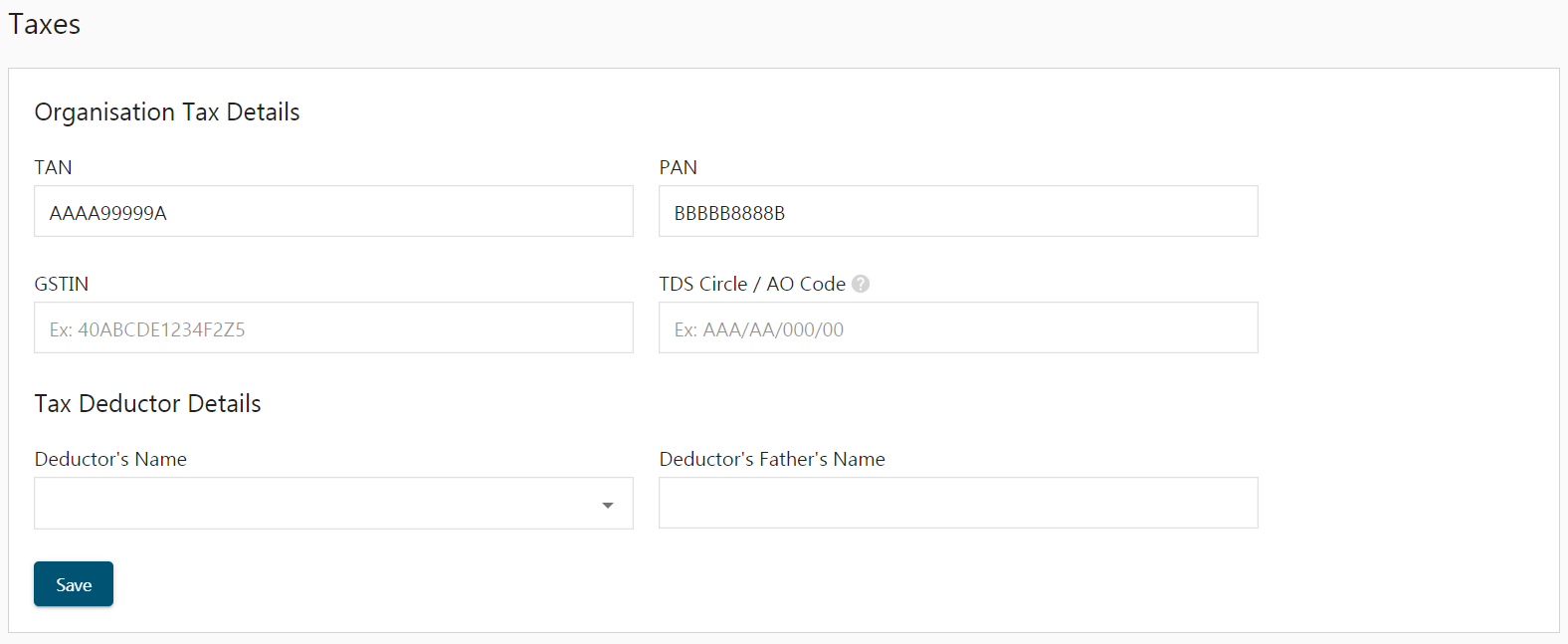

You may amend the tax details for your company in this area. We’ll use these facts to create Form 16 for your employees.

Enter your Organization Tax Details like TAN, PAN, GSTIN, TDS Circle/AO Code. Also, add Tax deductor details. Finally, click Save.

Permanent Account Number

A PAN card is a basic requirement for every corporate in India. It is a 10-digit identification number consisting of letters and digits that can be used for any financial dealings in India.

For any taxpayer, the Permanent Account Number (PAN) card is essential. The PAN card has various uses such as opening a bank account and filing tax returns.

In India, the PAN card has been made mandatory by the Income Tax Department as it requires a PAN number to open a bank account or file income tax returns. If you are an NRI, then you must also have a PAN issued in order to file your tax returns in India.

TAN

TAN is a unique 10-digit alphanumeric code. It is issued by the Income Tax Department, which uses this number to withhold income tax from an individual’s monthly wage. It is also used as a unique identifier by businesses in India who are required by law to deduct or collect tax from their customers.

The TAN is allotted by the Government of India to every business which deducts or collects tax. A Payroll company that is required to deduct tax from your salary must have a TAN.

Assessing Officer

The AO Code is a number that’s assigned to an Assessing Officer by the Income Tax Department. This code is six-digit and helps you distinguish between multiple assessing officers working on your case.

Wherever you are, you can find AO Code details by logging into My Profile or Income Tax Office, which provides complete information about AO Code.

For example, if you have multiple employers and there are two assessing officers (one for each employer), the AO Code will help you identify where to send your monthly TDS certificates.

TDS Circle

Tax Payment Frequency is the frequency with which you deposit your Tax Deducted at Source (TDS) to the Income Tax Department.

Tax Deductor Detail

A tax deductor is a person who deducts tax from your salary and deposits it to the Income Tax department. Select your organization’s tax deductor from this drop-down, select their father’s name and proceed further.