Compensation refers to the money and benefits that an employee receives in return for their services to the organization. The overall purposes of granting compensation are to attract, retain and motivate employees.

Compensation includes direct cash payments, indirect payments in the form of employee benefits, and incentives to motivate employees to strive for higher productivity levels but before deducting any tax.

Money and benefits may be of different forms like compensation in cash or monetary form and various benefits, Provident Fund, Gratuity, and Insurance scheme or any other payment which the employee enjoys his perks or benefits in such cases of payment.

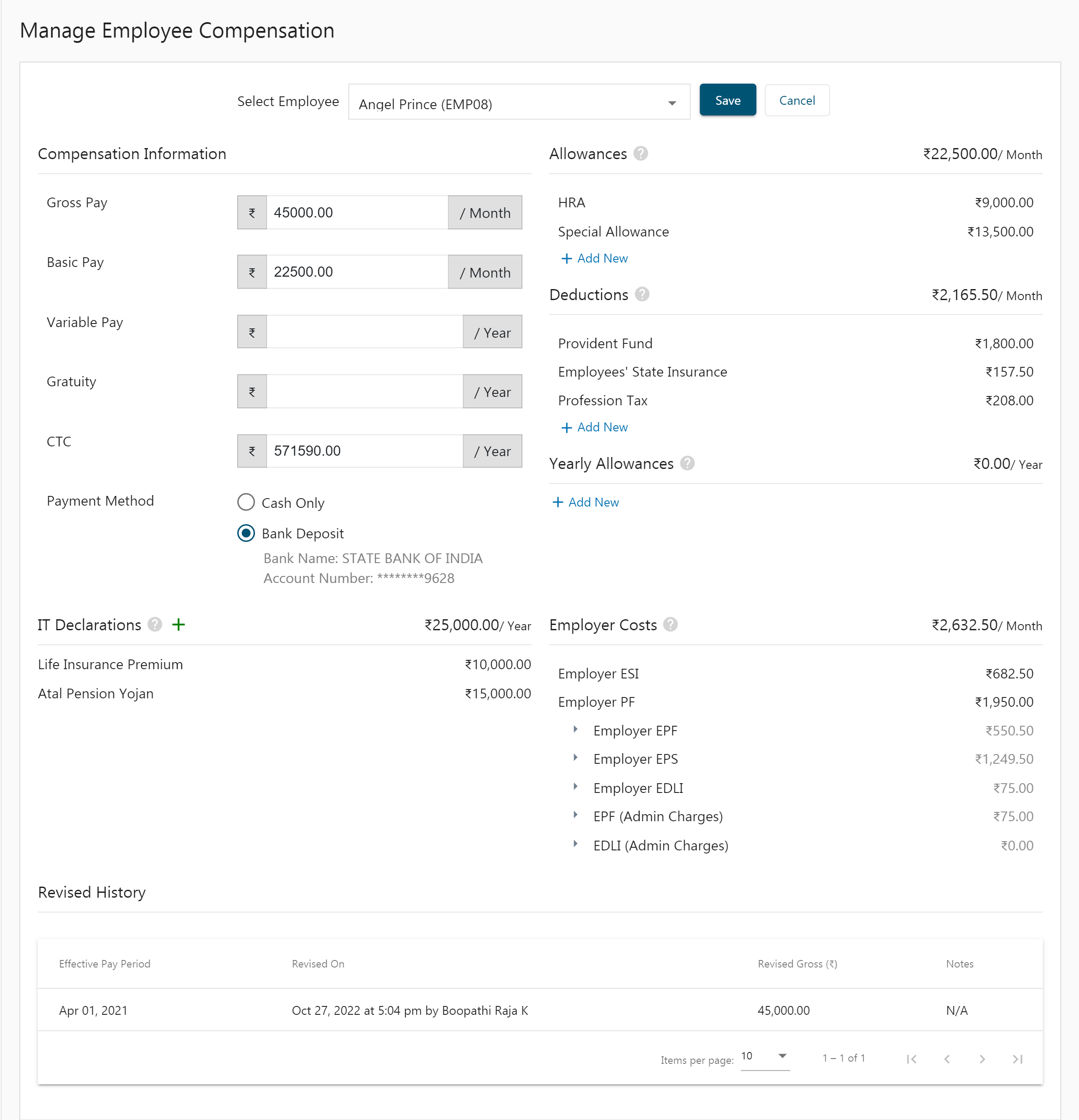

Gross Compensation – The monthly salary before any deductions.

Basic salary - The amount given to an employee before any additional benefits are added or subtracted.

Gratuity - It is paid as a reward for the employee’s long service rendered.

CTC - Cost to Company (CTC) refers to the total salary package of the employee. All monthly components, such as basic salary, reimbursements, various allowances, and so on, are included.

Allowances

Employers offer various kinds of additional benefits in monetary terms to their employees over and above the basic salary, which are known as salary allowances.

HRA (House rent allowance) - A House Rent Allowance is one of the most important compensation components provided by employers to their workers for housing expenses.

Deduction

PF - Provident fund is a government-managed retirement savings scheme for employees who can contribute a part of their pension fund every month.

ESI - ESI is a contributory fund that allows Indian employees to contribute to a self-financed healthcare insurance fund that is funded by both the employee and the company.

Profession Tax - Professional tax is a tax that is levied by a state government on all individuals who earn a living through any medium.

IT Declaration

An income-tax (IT) declaration is a statement of your investments that allows you to earn the most tax benefits possible.

Employer Cost

The total amount of money that it costs a company to employ people, including pay, insurance, benefits, etc.

Revised History

It gives details on the pay period, the date that the salary was revised and the revised gross salary.

How to manage Employee Compensation?

- Select an employee from the drop-down.

- Click on the Edit or Add Compensation button.

- Enter the Compensation information like Gross Pay, Basic pay, Variable Pay, Gratuity and CTC.

- Choose the payment method i.e. By cash or Bank Deposit

- Upload IT declaration.

- Click on +Add New to add allowances like HRA, special allowances, etc.

- Similarly add Deductions like PF, ESI and PT.

- Add Yearly allowances if any.

- The Employer Costs include the EPF and ESI breakdowns contributed by the employer.

- Revised History shows the previous revisions made in the employee’s salary.