Here we have mentioned certain enactments passed by the Government for the employers which include Income Tax, Professional Tax, Employee Provident Fund Organization (EPFO), and Employees’ State Insurance Corporation (ESIC). The tax rates keep increasing with an increase in the income of the taxpayer. Employees and employers both make contributions to their long-term financial and social well-being.

The four main Statutory Components in India are:

- Income Tax

- Professional Tax (PT)

- Employee Provident Fund (EPF)

- Employee State Insurance (ESI)

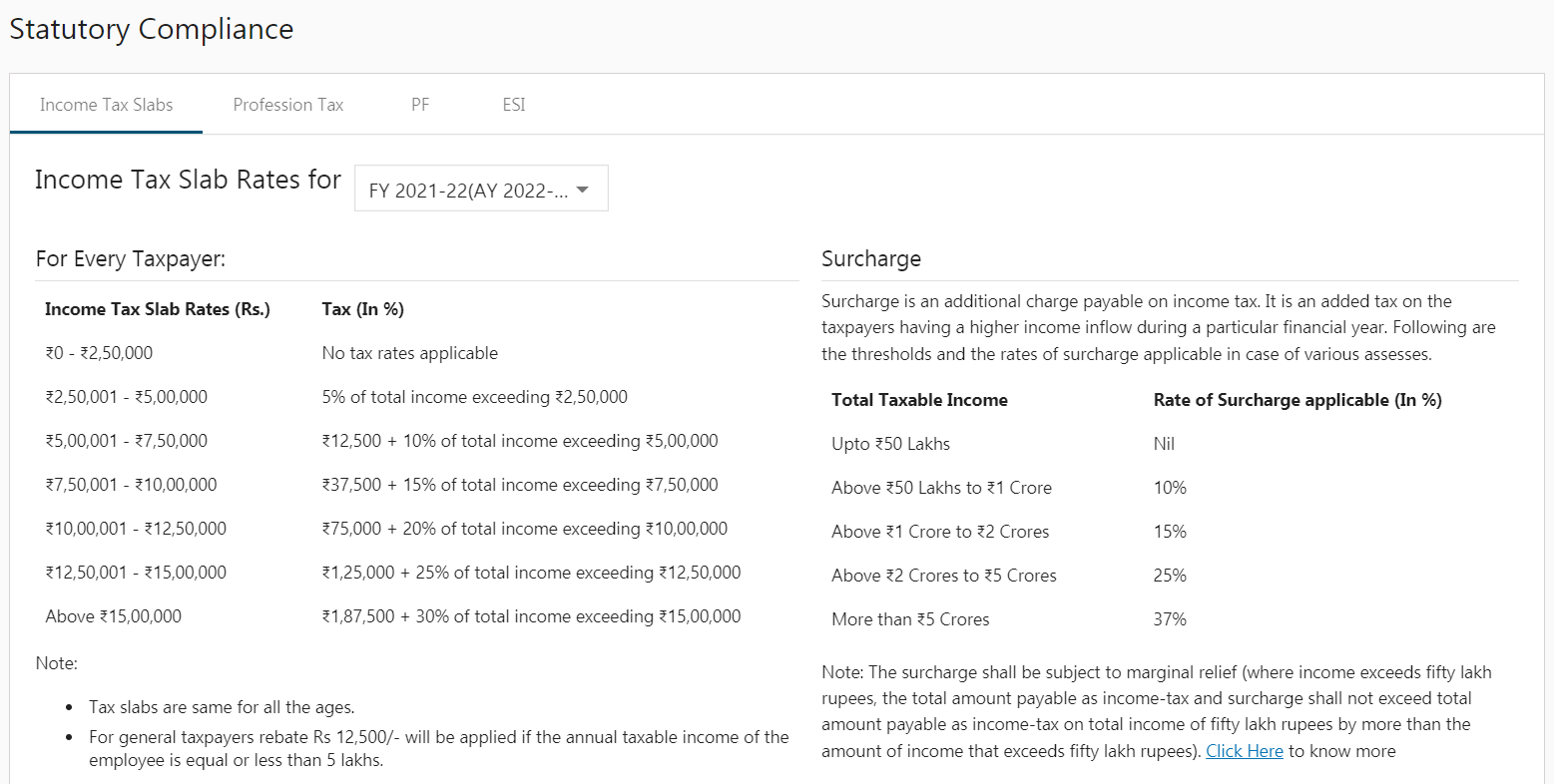

Income Tax

Based on the Indian Taxation System every individual taxpayer has to pay income tax depending on their income. If the individual salary is above ₹50 Lakhs, an additional tax called Surcharge is payable on income tax. Currently, there are two different tax regimes namely the old regime and the new regime. Under the old regime, the taxpayers can avail of tax rebates and exemptions based on investments whereas, in the new regime, they can’t. Based on the income and the Indian Taxation System, individual taxpayers are charged different tax amounts.

To know more about the Indian Taxation System click on https://cleartax.in/s/income-tax-slabs

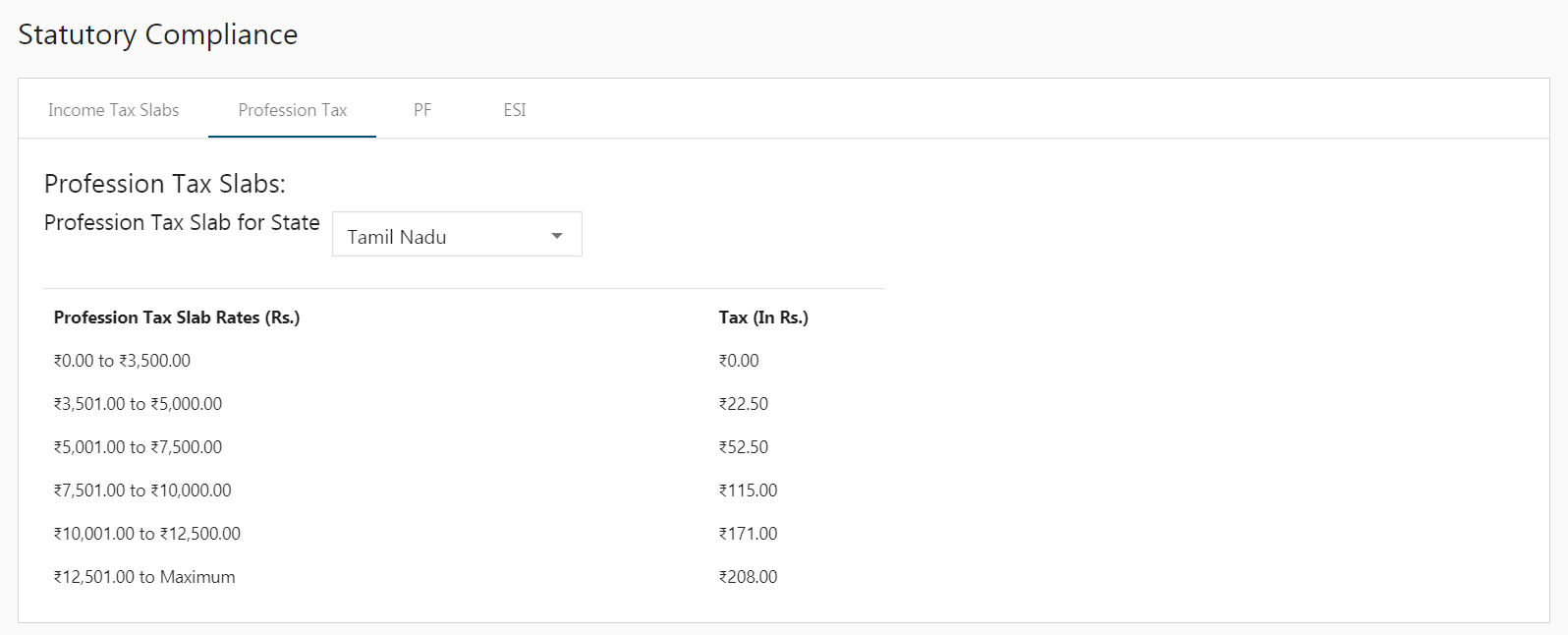

Professional Tax

Professional Tax is collected on all professional and salaried individuals by the State Government. Employees have to pay the respective amount as a tax based on their salary slab. These tax slabs varies with every state. Depending upon the salary the deduction cycle may be monthly, half-yearly, or yearly.

Professional Tax Guidelines

The professional tax varies with every state.

- In Andhra Pradesh, for individual salary ranges from ₹15,001 to ₹20,000 the tax amount is ₹200.

- In Gujarat, for individual salary ranges of ₹12,000 or above, the tax rate is ₹200.

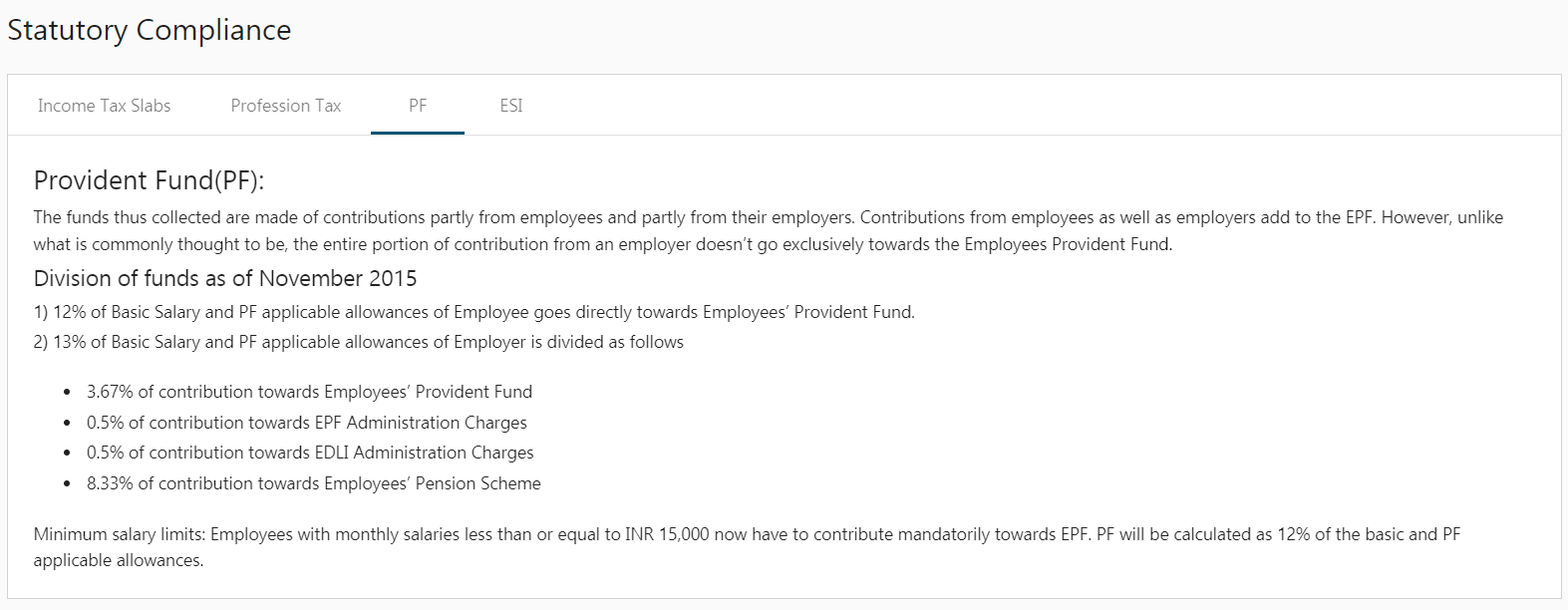

Employee Provident Fund (EPF)

Employee Provident Fund is a retirement benefits scheme for all employees who are working under an organization. The main purpose of the EPF is help employees to save a fraction of the amount every month (12% of Basic Pay + PF Applicable Allowance) for their future needs. After they retire or if they develop any disability the amount from this scheme can be used.

EPF Guidelines

The employees earning less than ₹15,000 per month must invest in EPF. Both employee and employer have to contribute 12% of (Basic Pay + PF Applicable Allowance).

If the employer contribution(PF) is 10%:

- Employer EPF: 0.67%

- Employer EPS: 8.33%

- Employer EDLI: 0.50%

- EPF (Admin Charges) 0.50%

- EDLI (Admin Charges) 0.00%

If the employer contribution(PF) is 12%:

- Employer EPF: 3.67%

- Employer EPS: 8.33%

- Employer EDLI: 0.00%

- EPF (Admin Charges) 0.00%

- EDLI (Admin Charges) 0.00%

If the employer contribution(PF) is 13%:

- Employer EPF: 3.67%

- Employer EPS: 8.33%

- Employer EDLI: 0.5%

- EPF (Admin Charges) 0.5%

- EDLI (Admin Charges) 0.00%

On the 15th of every month, the employer must deposit the PF payments. Employees who wish to contribute more than 12% can do it to the VPF.

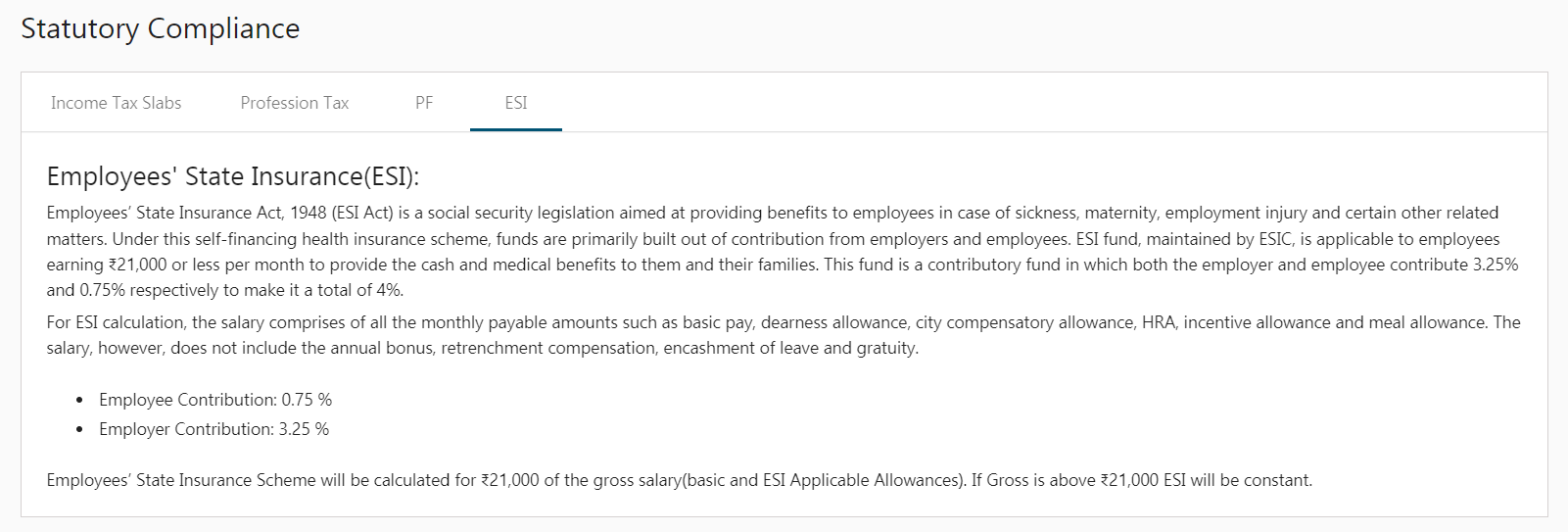

Employee State Insurance

ESI is self-financing social security and health insurance scheme applicable to employees whose monthly earnings are less than or equal to ₹21,000. These employees mandatorily pay 0.75% of Gross Pay and the employer’s contribution would be 3.25% of Gross Pay. This scheme is available in all states except Manipur, Sikkim, Arunachal Pradesh, and Mizoram.

ESI Guidelines

- Employees whose monthly salary is less than or equal to 21,000 can opt for ESI.

- Employee’s contribution is 0.75% of Basic Pay + ESI Applicable Allowances.

- Employer’s contribution is 3.25% of Basic Pay + ESI Applicable Allowances.

- The employer has to deposit the ESI amount within the 15th of next month.