The estimated tax sheet gives information about the tax paid until the time for which the payroll had been run and the future estimate of the remaining tax to be paid in a financial year.

An estimated tax sheet can be generated for a particular financial year and only for those employees for whom the compensation has been set.

How to view the estimated tax sheet?

- Select the Estimated Tax Sheet menu from the sidebar.

- Choose the Financial Year from the drop-down.

- Select the employee for whom you would like to generate a tax sheet.

- Click Apply.

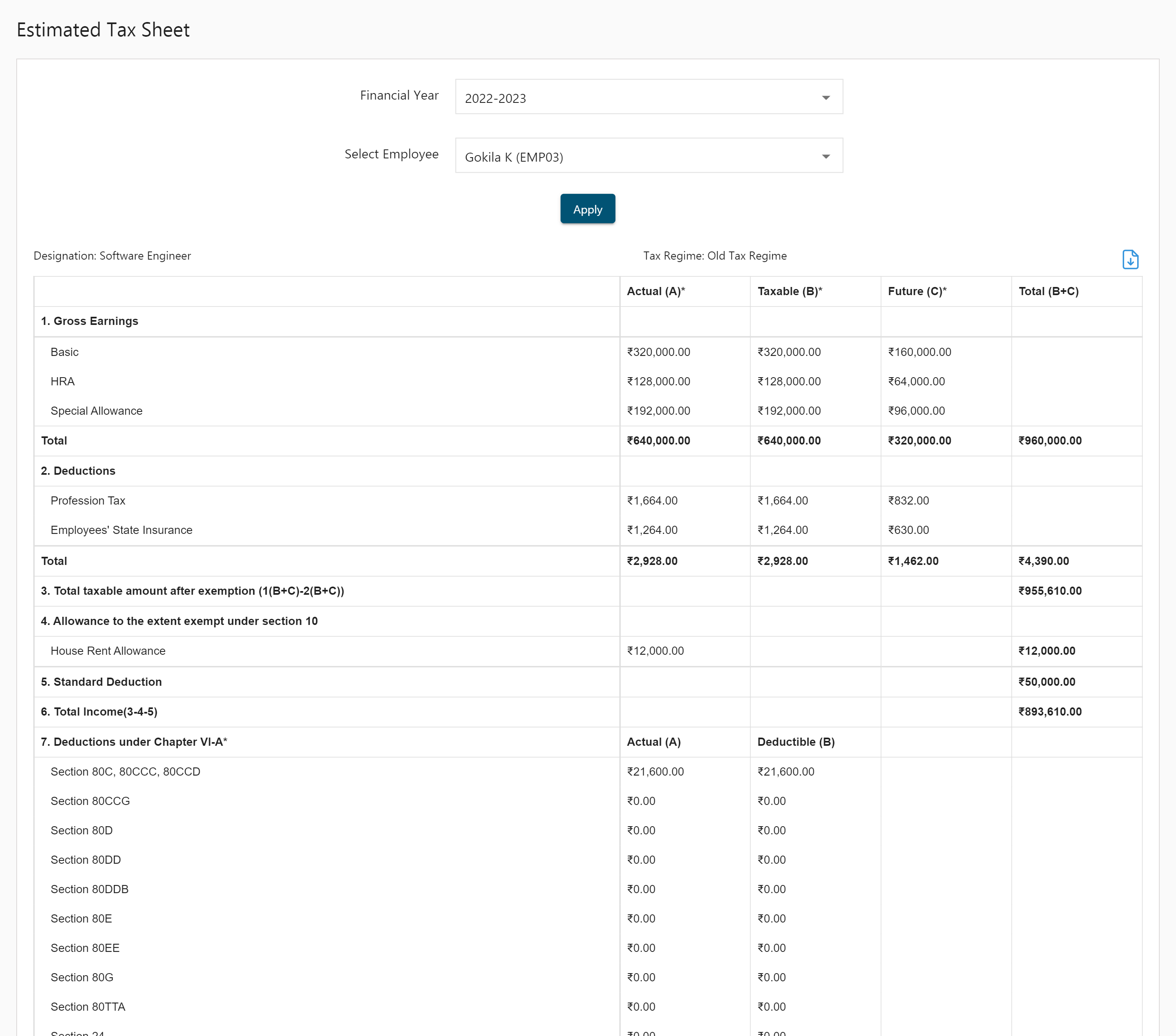

- The tax sheet displays the employee designation and the tax regime on top of a table displaying information like Gross Earnings, Deductions, Total taxable income, Tax calculations, Taxes paid to date and taxes to be paid in the near future.

- The Actual amount refers to the amount set for components like Basic Pay, Allowances, Deductions etc, during setting the compensation for an employee.

- Future Amount refers to the Actual amount*remaining months for which tax has to be calculated.

-

The Total amount is calculated as follows:

Income/Deduction Total Gross Earning Taxable + Future Deductions (Taxable + Future) of Pre-Tax Deductions Total taxable amount after exemption (Gross(Taxable + Future) -Deduction (Taxable + Future)) Standard Deductions 50,000 Total Income (Total taxable amount after exemption) - (Allowance to the extent exempt under section 10(HRA)) - (Standard Deduction(50,000)) Total Taxable Income after deducting Chapter VI-A deductions (Total Income)-(Deductions under Chapter VI-A*Deductible) Total Tax Tax(5%)+Tax(20%)+Tax(30%) if old Tax regime Note: Percentages differ according to the Tax regime opted. - Click on the PDF icon to get a PDF of the Estimated Tax Sheet.