Usually, the management lead or Human Resource person directly calculates payroll for every month or given duration by the company whereas Zenyo Payroll, automates your company’s payroll.

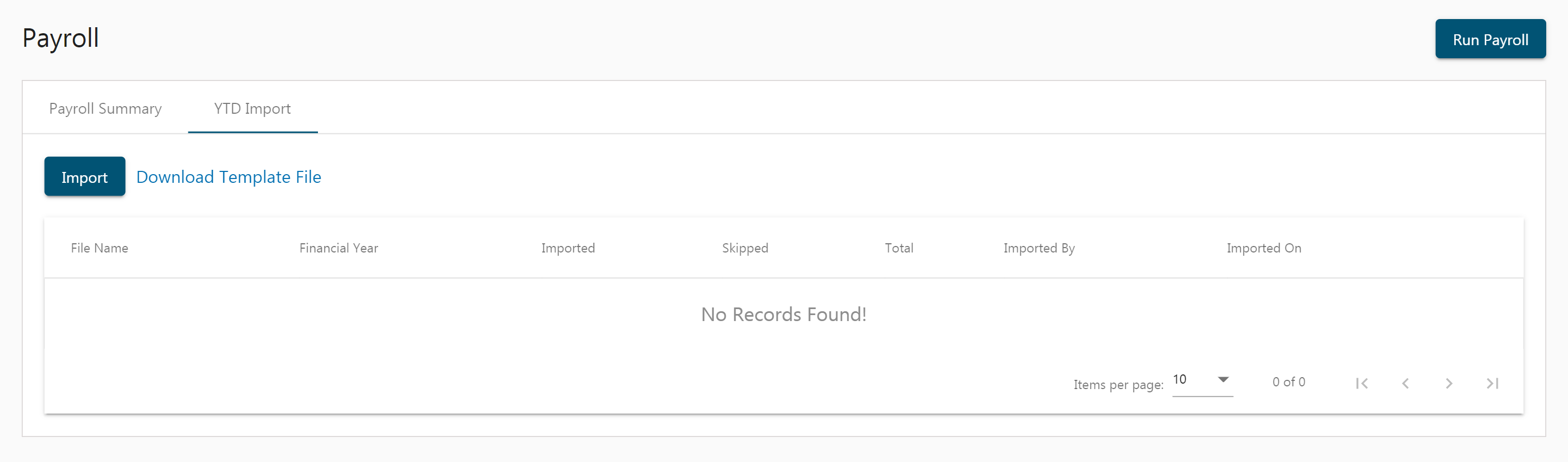

The Payroll Section contains two tabs:

- Payroll Summary

- YTD Import

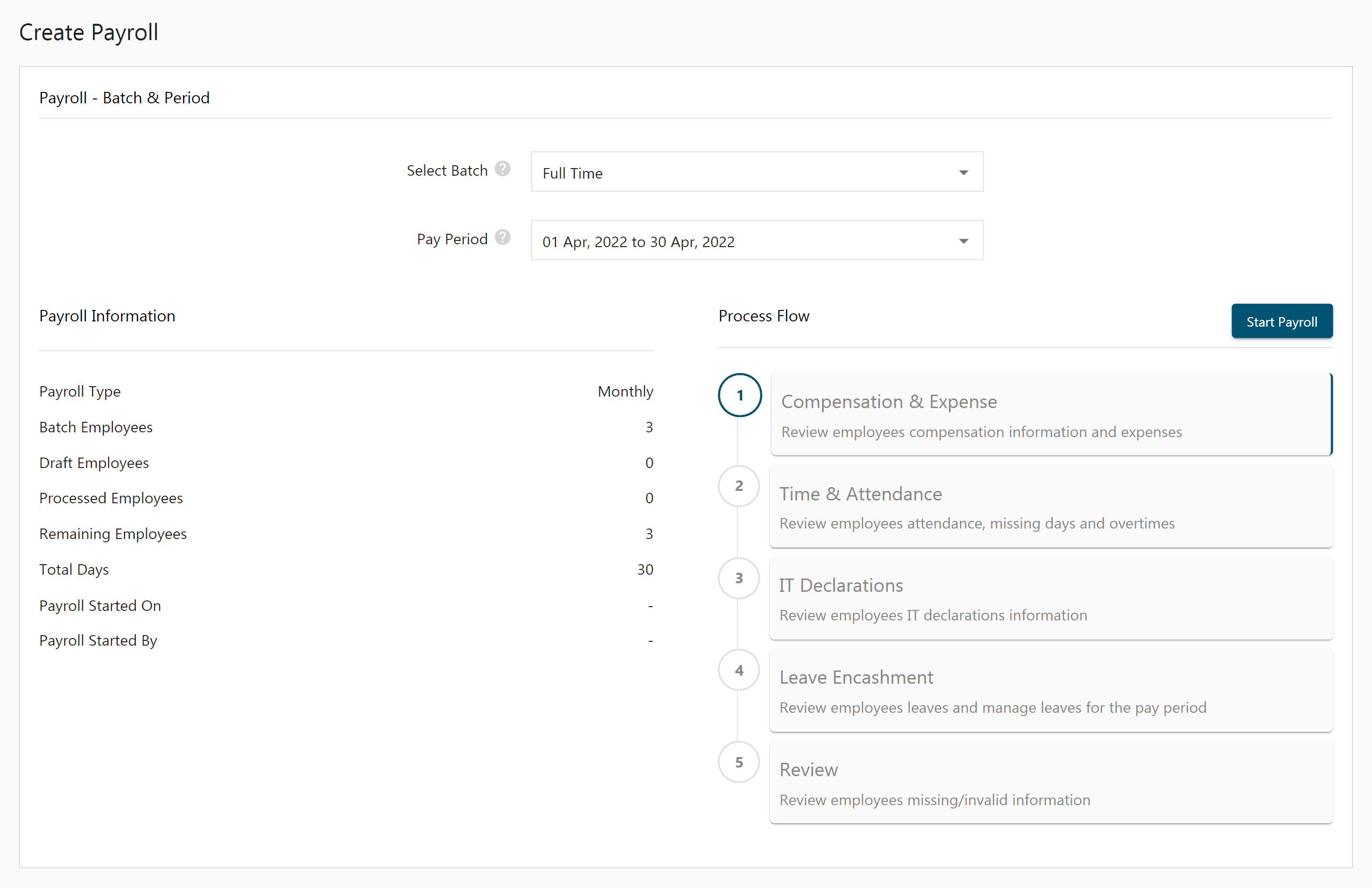

How to create and process payroll in Zenyo Payroll?

- Select a Batch & Pay Period to process the payroll.

- Additionally, you can view the payroll information and payroll process flow.

- By completing the process flow, the payroll schedule will be processed for every duration.

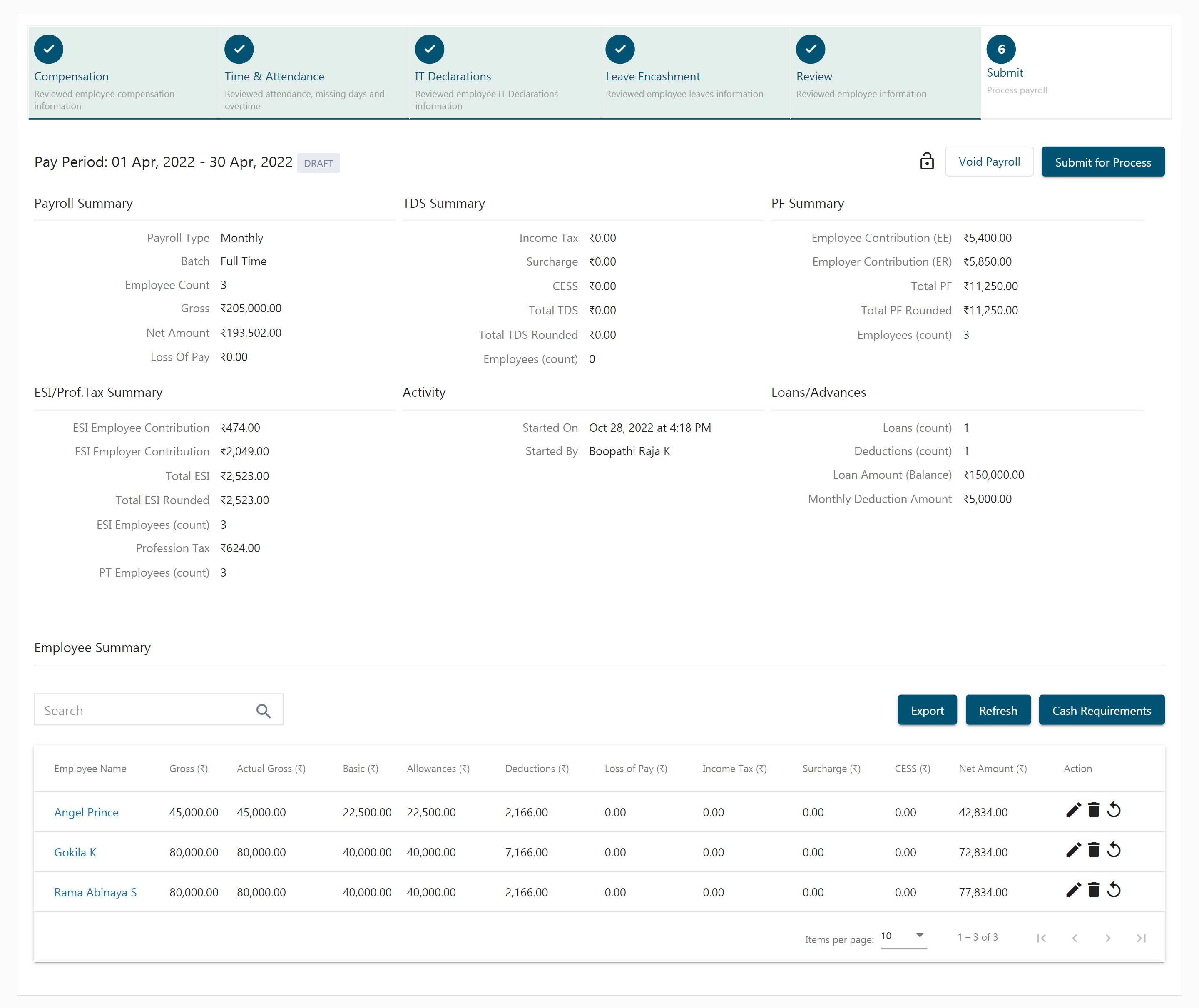

Processing Payroll

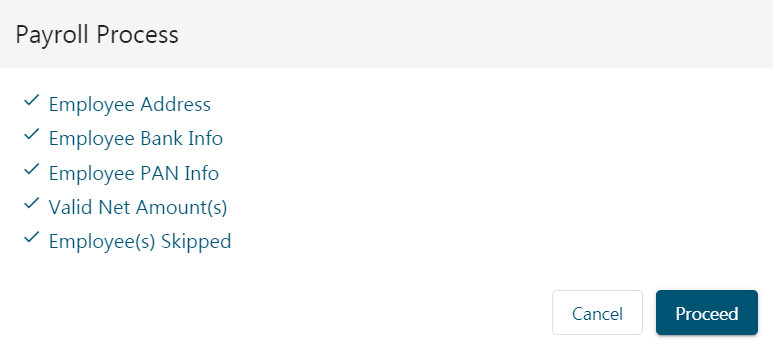

- To process the payroll, click on Submit for Process.

- If data gets mismatched, you can revoke it by clicking refresh or undo.

- To download the employee and payroll information, click on the Export button.

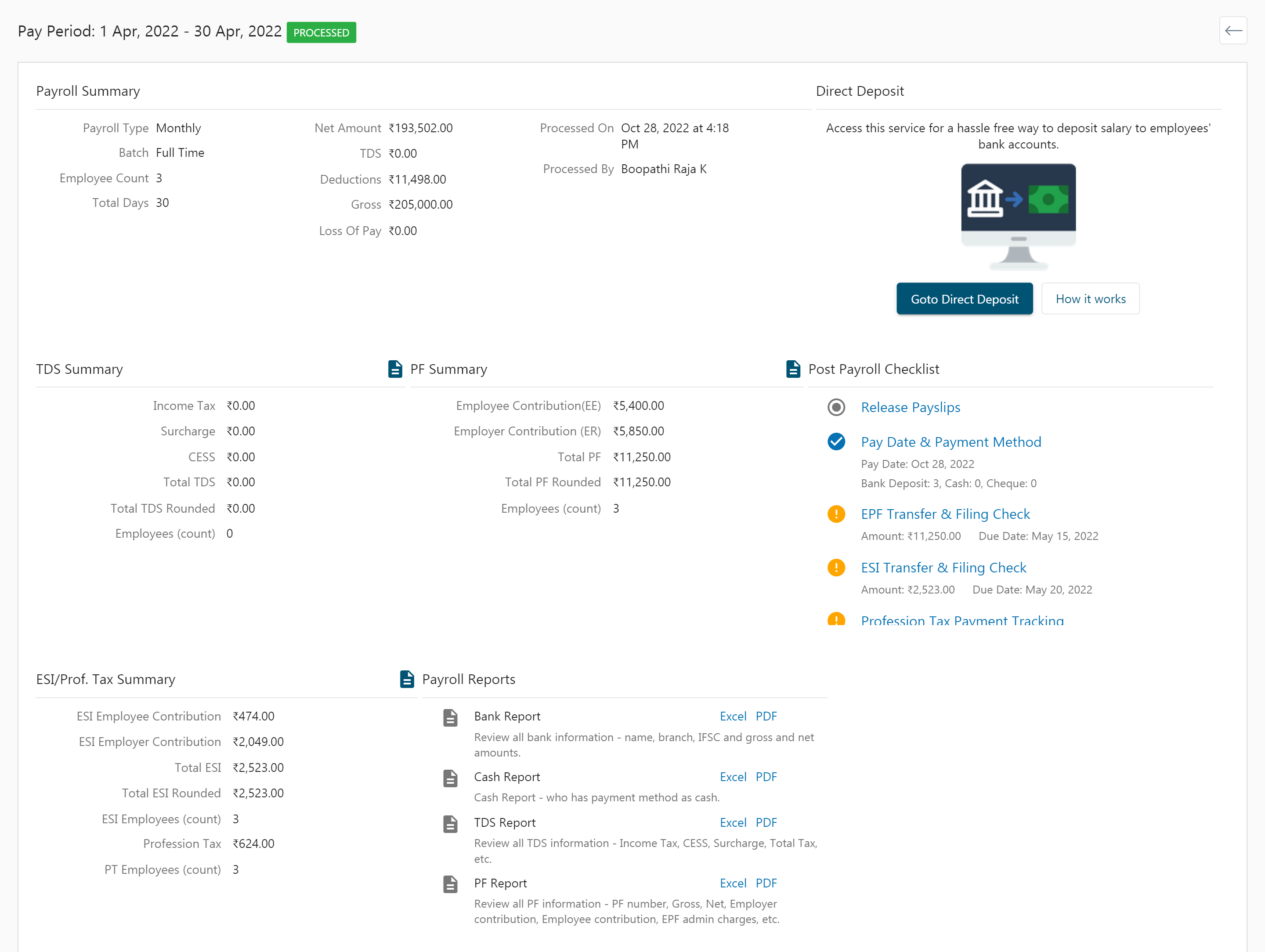

Processed Payroll

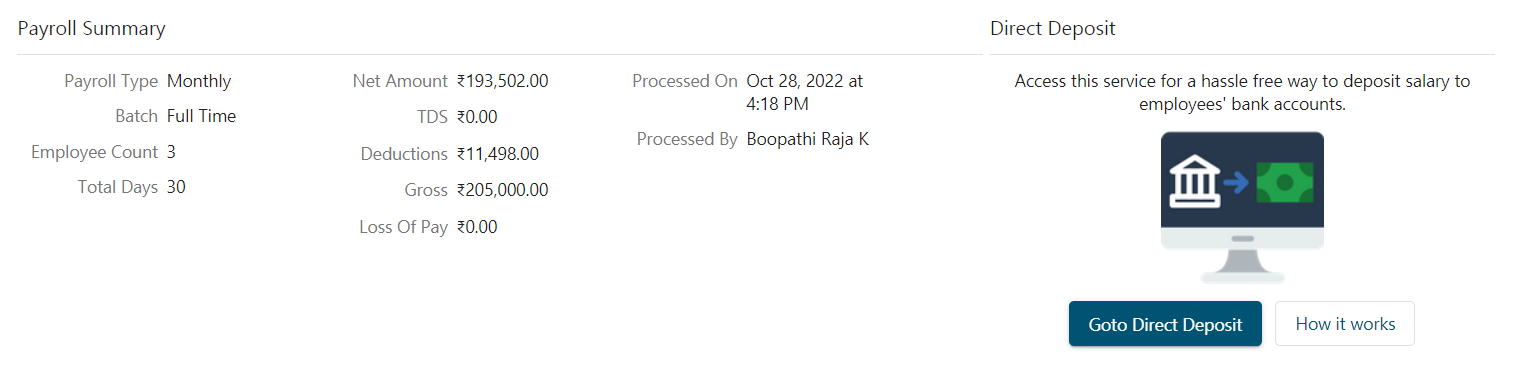

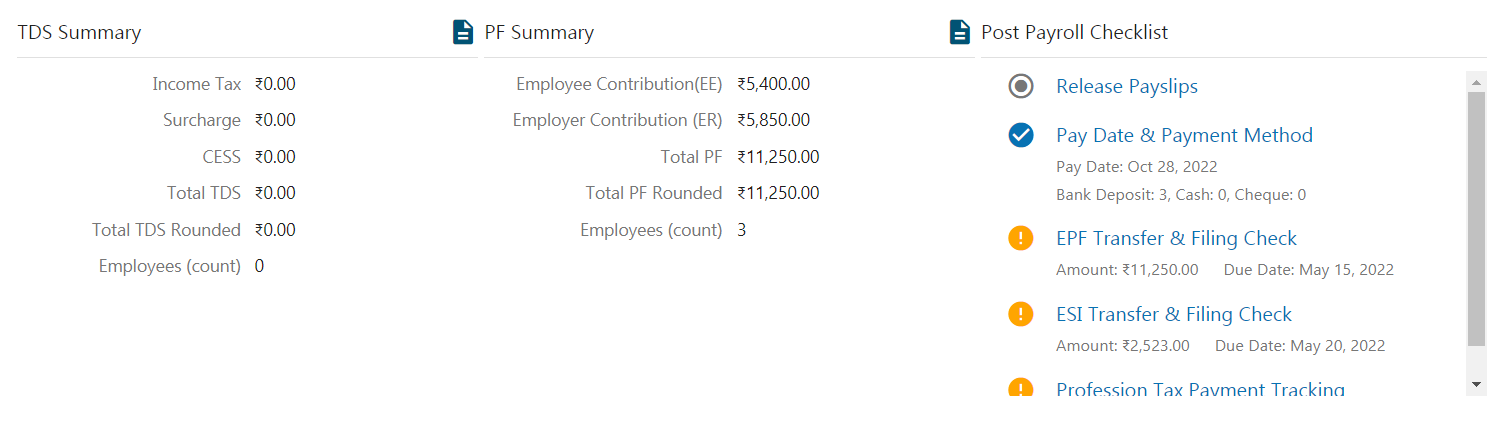

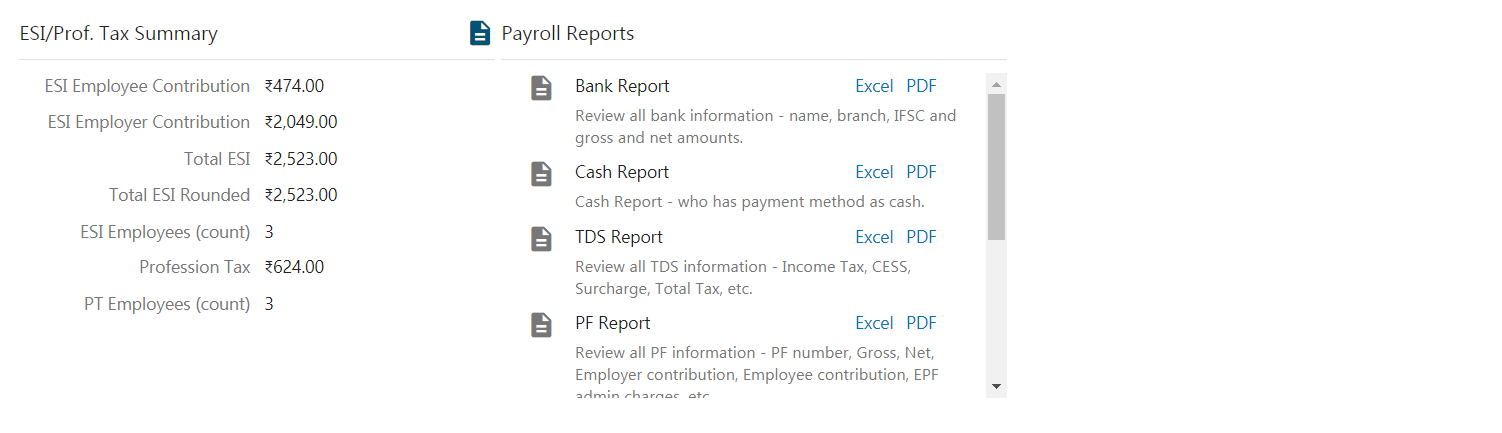

The processed payroll shows the Payroll Summary, TDS Summary, PF Summary, and Payroll Reports.

The initial section contains a Payroll summary along with details used for processing the salary.

The following section displays a summary of TDS & PF info. You can also choose to release or withhold the payslips.

The last section displays the Tax/ESI summary & Payroll Reports for easy access. The Final portion shows the employee details for whom the payroll was run. Should you find the need to search for a particular employee, do so using the Search bar. The Release Payslip section allows employers to withhold or run payslips per their preferences.

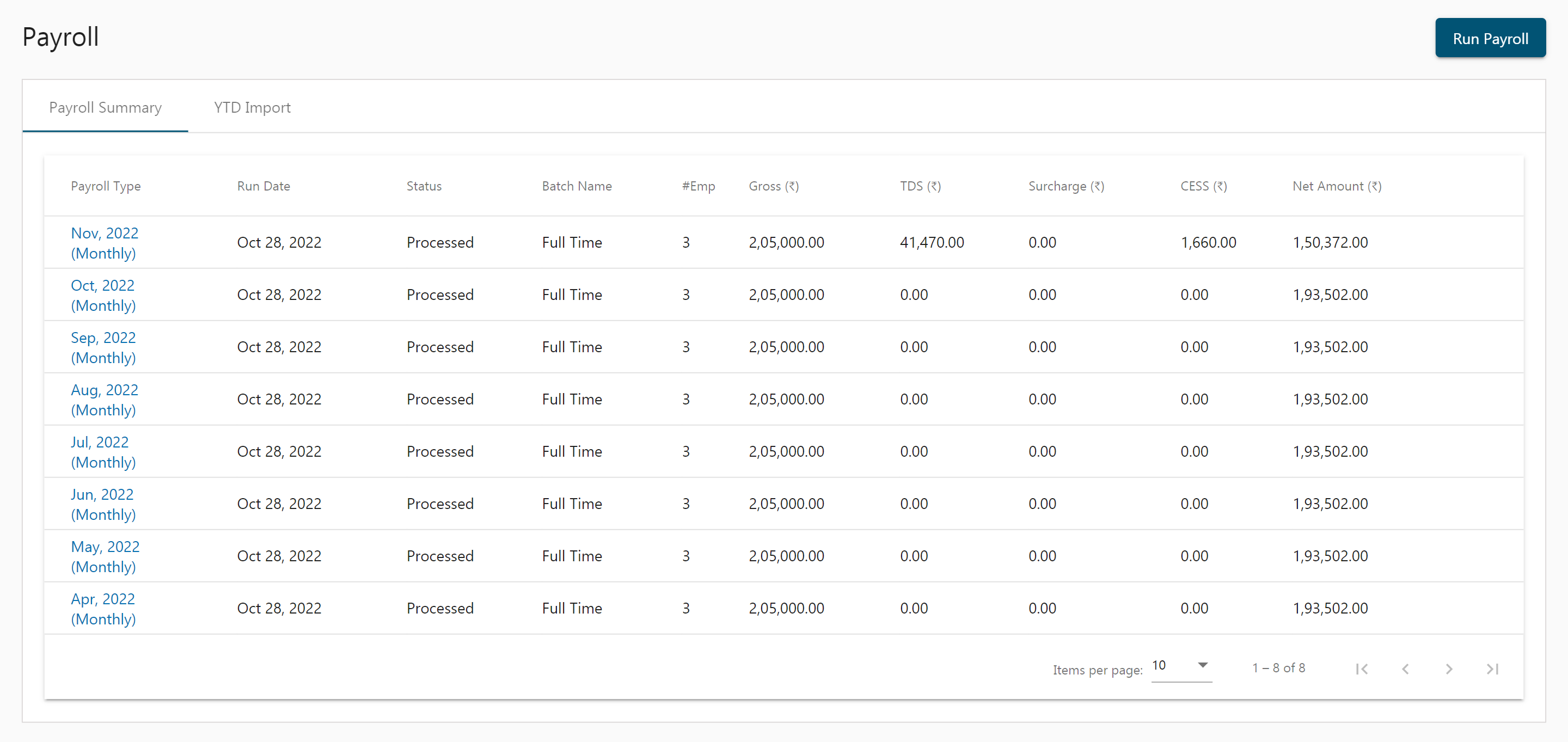

Payroll Summary

The Payroll Summary as the name suggests displays all details of the previously run Payroll.

Clicking on the Payroll Type, for the particular payroll takes you to a new screen that holds crucial information. If it’s in the draft state you can process the payroll based on necessary.

YTD Import

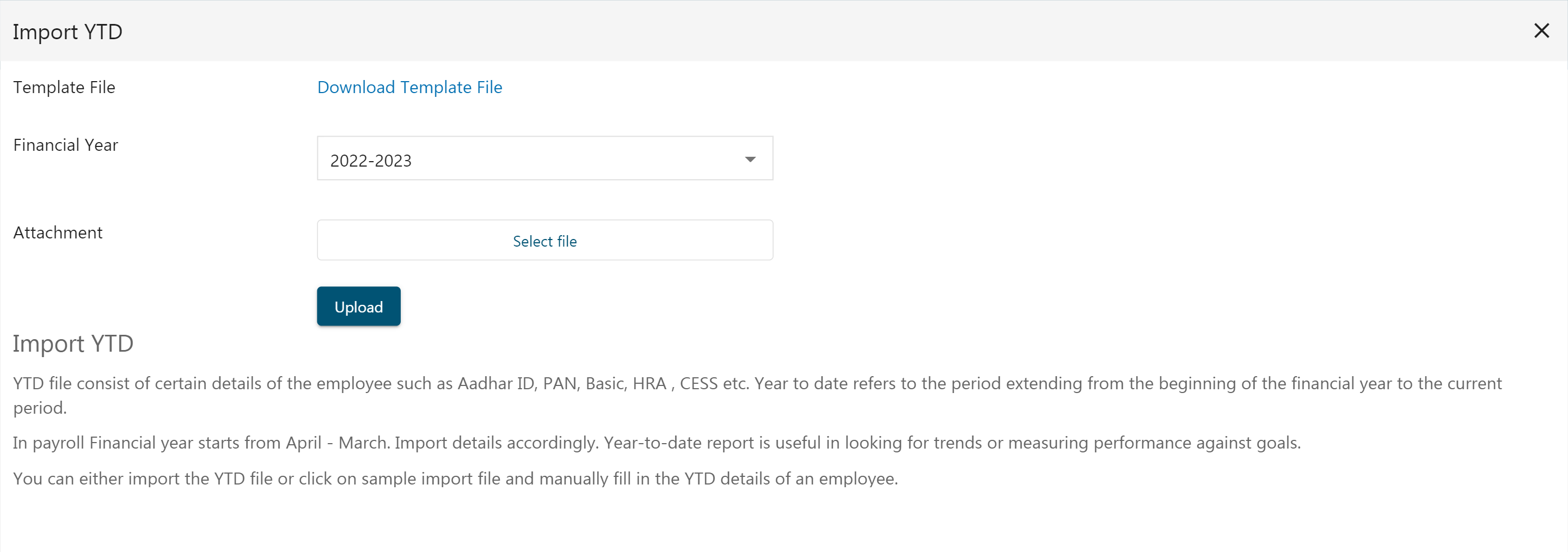

Year To Date is calculated when an employee joins your organization in the middle of the financial year, the employee details will be added to the YTD panel to process the payroll. Similarly, when your organization purchases and configured Zenyo Payroll in the middle of the financial year, YTD is used.

To upload the YTD data first, download the predetermined template.

Then click on Import to insert your organization data and then import the file.

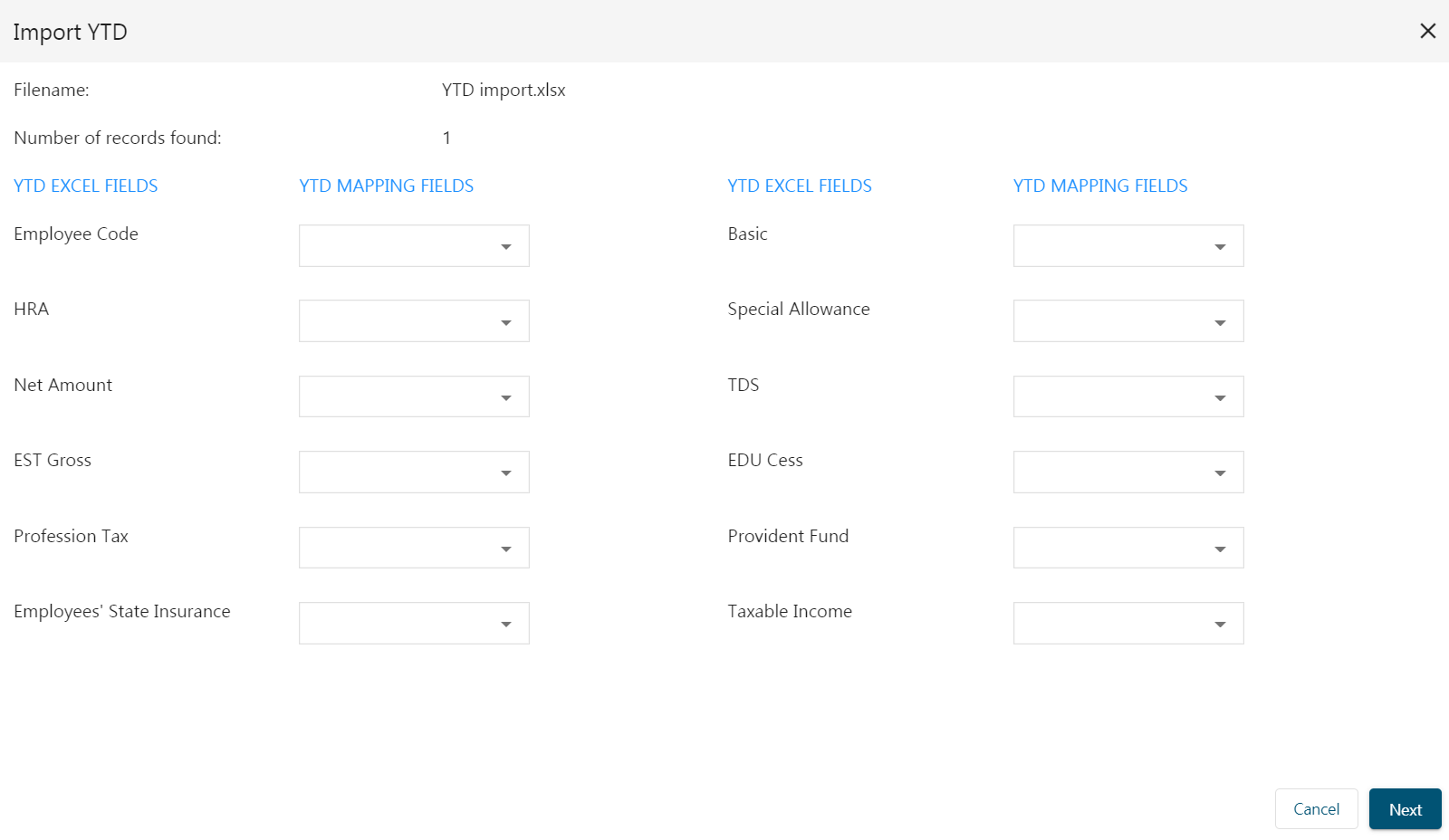

Then you have to map the information such as Employee Code, HRA, Net Amount, EST Gross, Professional Tax, ESI, Basic, Special Allowance, TDS, Cess, PF, and Taxable Income.

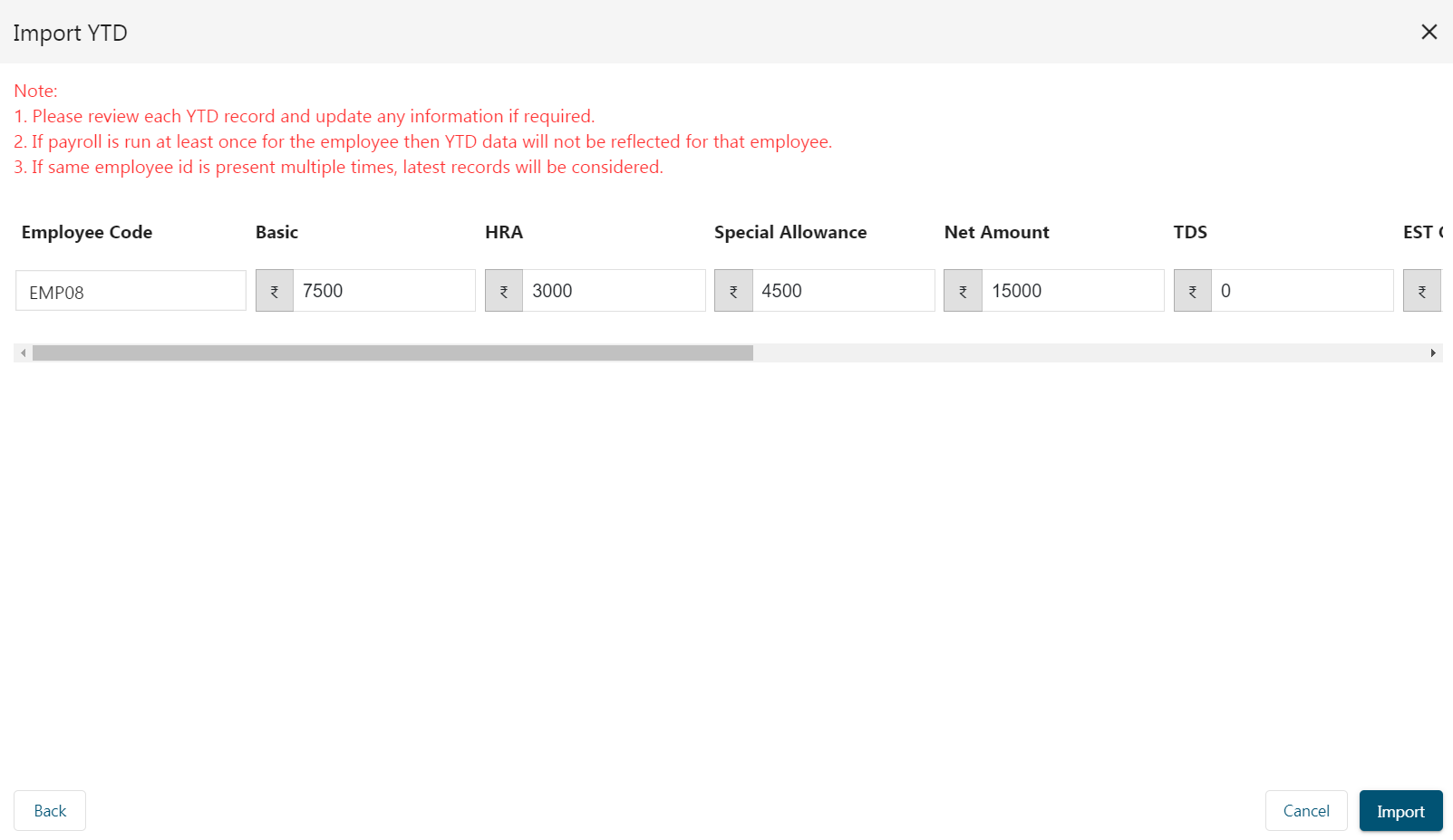

The details of each employee will be added to the YTD.

It displays the file name, financial year, imported, skipped, total, imported by and imported on details.