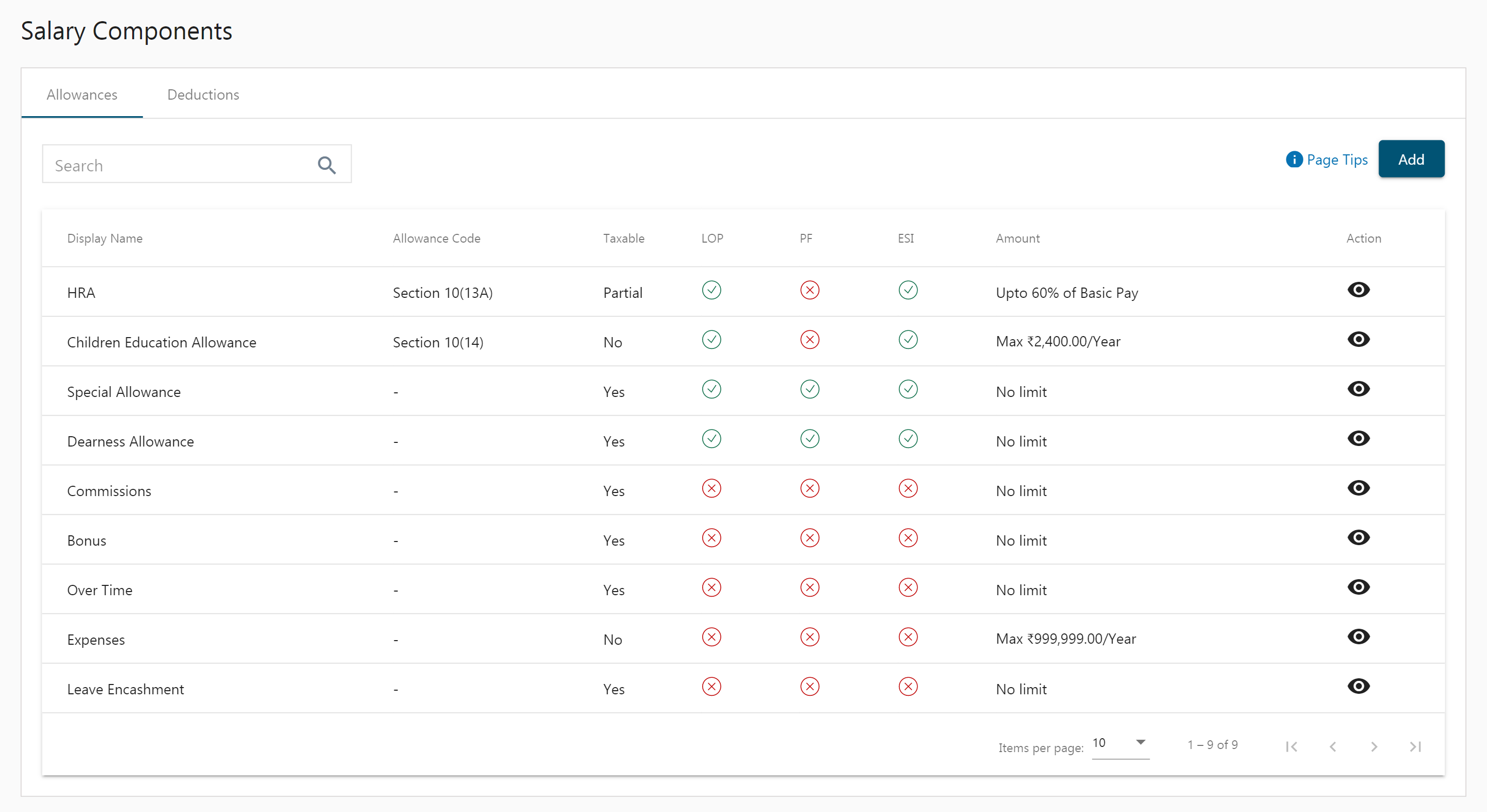

A salary consists of two components - Allowances and deductions. By default, there are some existing allowances and deductions set up for the organization globally. These allowances and deductions cannot be edited or deleted but can only be viewed. However, you can add new allowances or deductions if required.

Adding Allowances

- On the Settings page, choose the Salary Components menu.

- Choose the Allowances tab. Click on the Add button.

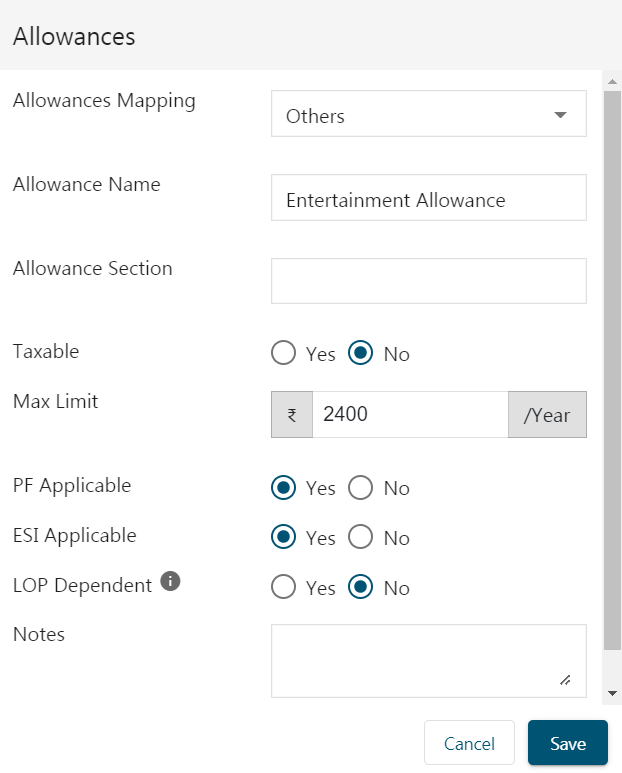

- Enter the allowance details like name, section, and mapping.

- Mention whether the allowance is Taxable, PF applicable, ESI applicable and LOP dependent using radio buttons.

- Taxable - If No, then specify the limit up to which it is not taxable.

- PF applicable - It means this allowance will be included in the amount based on which PF will be calculated.

- ESI applicable - It means this allowance will be included in the amount based on which ESI will be calculated.

- LOP dependent - This allowance will depend on the LOPs every month.

- Click Save.

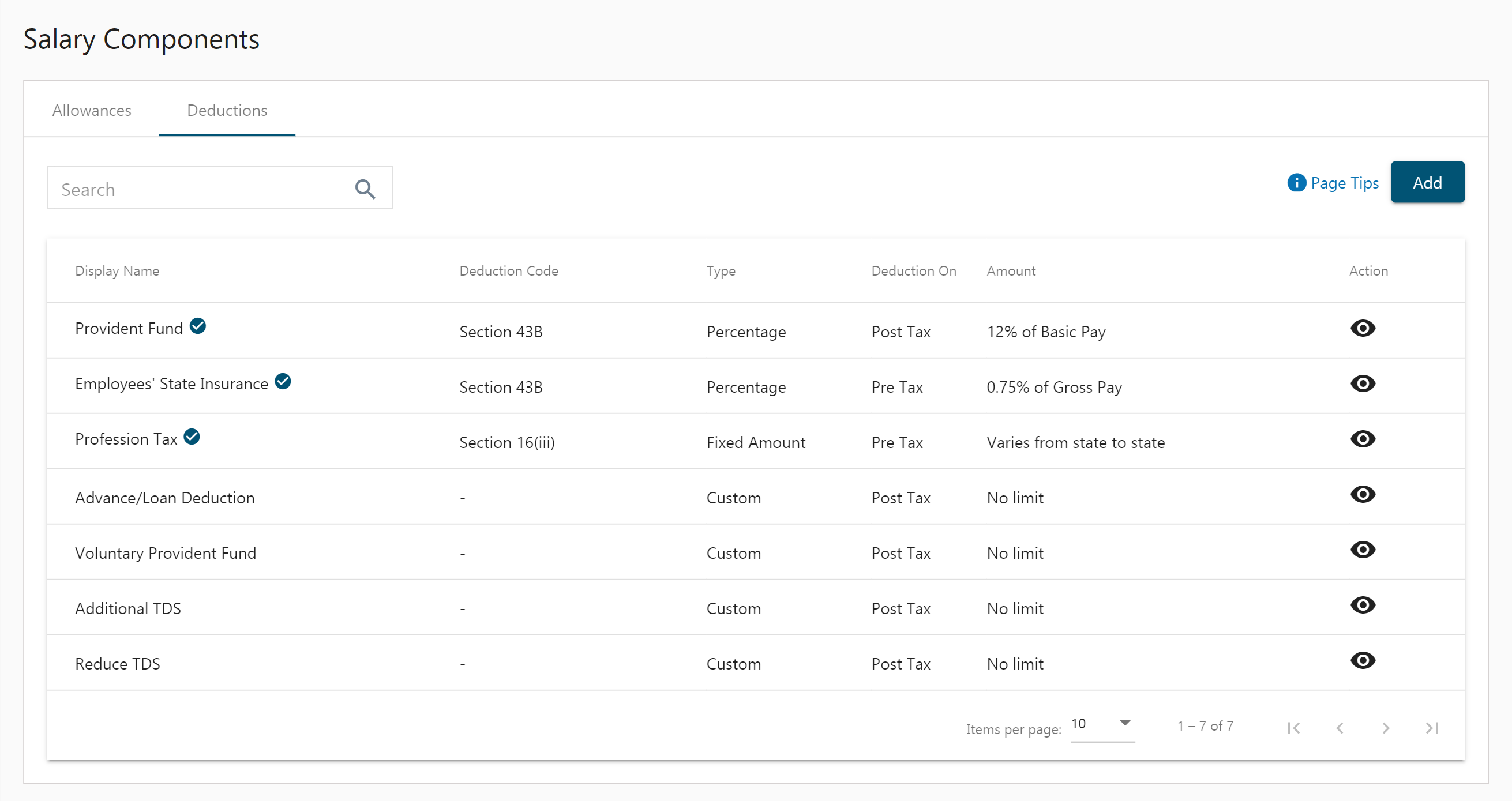

Adding Deductions

Deductions are money that’s taken from your employees’ monthly pay. There are two types of deductions,

- Pre-tax

- Post-tax

Pre-tax

A pre-tax deduction is money deducted from your salary before the calculation of income tax. As a result, your employee’s net taxable income is reduced, consequently, the tax is reduced. For example, deductions made towards schemes like ESI(Employees’ State Insurance and Professional Tax are considered pre-tax deducts. In addition, you can set additional deductions as Pre-Tax.

Post-tax

After the income tax has been determined, money is withheld from your employees’ salary as a post-tax deduction. This has no impact on the employee’s net taxable income. For example purchases made in the business grocery shop or food court are deductible after taxes. Post-tax deductions can be used to cover workplace benefits such as health insurance and retirement contributions.

To add a deduction,

- On the Settings page, choose the Salary Components menu.

- Choose the Deductions tab. Click on the Add button.

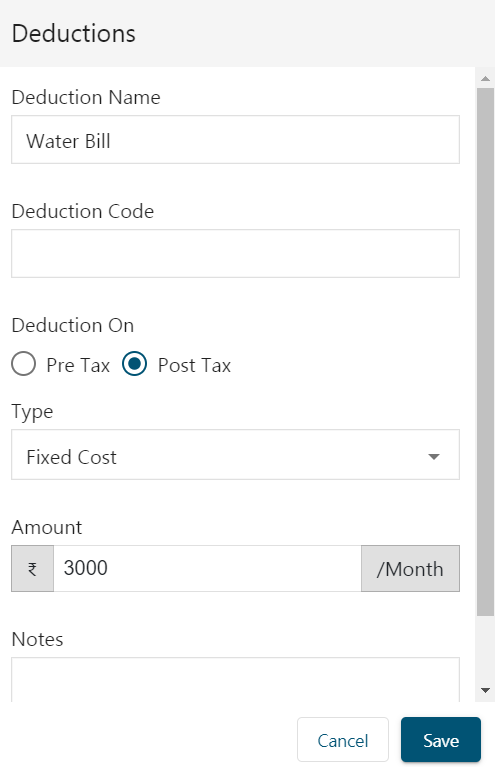

- Enter the details like deduction name and code.

- Choose whether the deduction should be on Pre-tax or Post-tax.

- Choose the type i.e. Percentage, Fixed Cost, or Custom.

- Percentage - Enter the % amount and choose Basic pay or Gross pay.

- Fixed - Enter the fixed amount/month.

- Custom - Amount can be entered when required.

- Click on Save.