Zenyo Payroll handles your employee’s Income Tax Saving Investments. Investment Declarations assist your employees in lowering the taxable income and increasing the take-home pay. Employees can declare the investments they have made and can submit proofs for the same. Zenyo Payroll easily calculates the income tax based on the type of investment and automates payroll for every month.

How can employees declare the investment details?

- Employees can use the IT declaration to declare their projected investments and anticipated expenses. An employee has to submit the IT declarations at the beginning of the financial year or the joining of the company.

- Zenyo Payroll calculates the employee’s taxable income based on the investments declared and deduces the tax amount each month.

- At the end of the financial year, the employee has to submit the proofs for each investment declared.

IT Declaration in Zenyo Payroll

In Zenyo Payroll under the financial year 2022- 2023, the employees can invest and submit the investment proof for the following:

- Additional Interest on Home Loan - Under section 80EEA, the maximum amount of investment is ₹150,000.00/Year.

- Additional Interest on Home Loan Borrowed - Under section 80EE, the maximum amount of investment is ₹50,000.00/Year.

- Atal Pension Yojana - Under section 80CCD (1), the maximum amount of investment is ₹50,000.00/Year.

- Children Tuition Fees - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Contribution to NPS - Under section 80CCD (1), the maximum amount of investment is ₹50,000.00/Year.

- Contribution to Pension Account - Under section 80CCD, the maximum amount of investment is ₹150,000.00/Year.

- Contribution to Pension Fund - Under section 80CCC, the maximum amount of investment is ₹150,000.00/Year.

- Deposit in NSC - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Deposit in NSS - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Deposit in Post Office Savings Scheme - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Donations (100%) - Under section 80G, the maximum amount of investment is ₹100,000,000.00/Year.

- Donations (50%) - Under section 80G, the maximum amount of investment is ₹100,000,000.00/Year.

- Equity Linked Scheme (ELS) - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Health Insurance Premium/Medical Expenditure/Preventive Health Check-Up - Under section 80D, the maximum amount of investment is ₹100,000.00/Year.

- House Rent - Under section 10(13A), the maximum amount of investment is ₹100,000,000.00/Year.

- Infrastructure Bonds - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Interest on Deposit in Savings Account - Under section 80TTA, the maximum amount of investment is ₹10,000.00/Year.

- Interest on Loan of higher self-education - Under section 80E, the maximum amount of investment is ₹100,000,000.00/Year.

- Interest on NSC Reinvested - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Kisan Vikas Patra (KVP) - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Life Insurance Premium - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Medical Expenditure for Disabled Dependent - Under section 80DD, the maximum amount of investment is ₹125,000.00/Year.

- Medical Expenditure for specified disease - Under section 80DDB, the maximum amount of investment is ₹100,000.00/Year.

- Mutual Funds - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- NHB Schemes - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Others - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Pradhan Mantri Suraksha Bima Yojana - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Public Provident Fund - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Rajiv Gandhi Equity Scheme - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Repayment of Housing loan (Interest amount) - Under section 24, the maximum amount of investment is ₹200,000.00/Year.

- Repayment of Housing loan (Principal amount) - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Stamp duty and Registration charges - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Sukanya Samriddhi Yojana - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

- Unit Linked Insurance Premium (ULIP) - Under section 80C, the maximum amount of investment is ₹150,000.00/Year.

How to add IT Declaration in Zenyo Payroll?

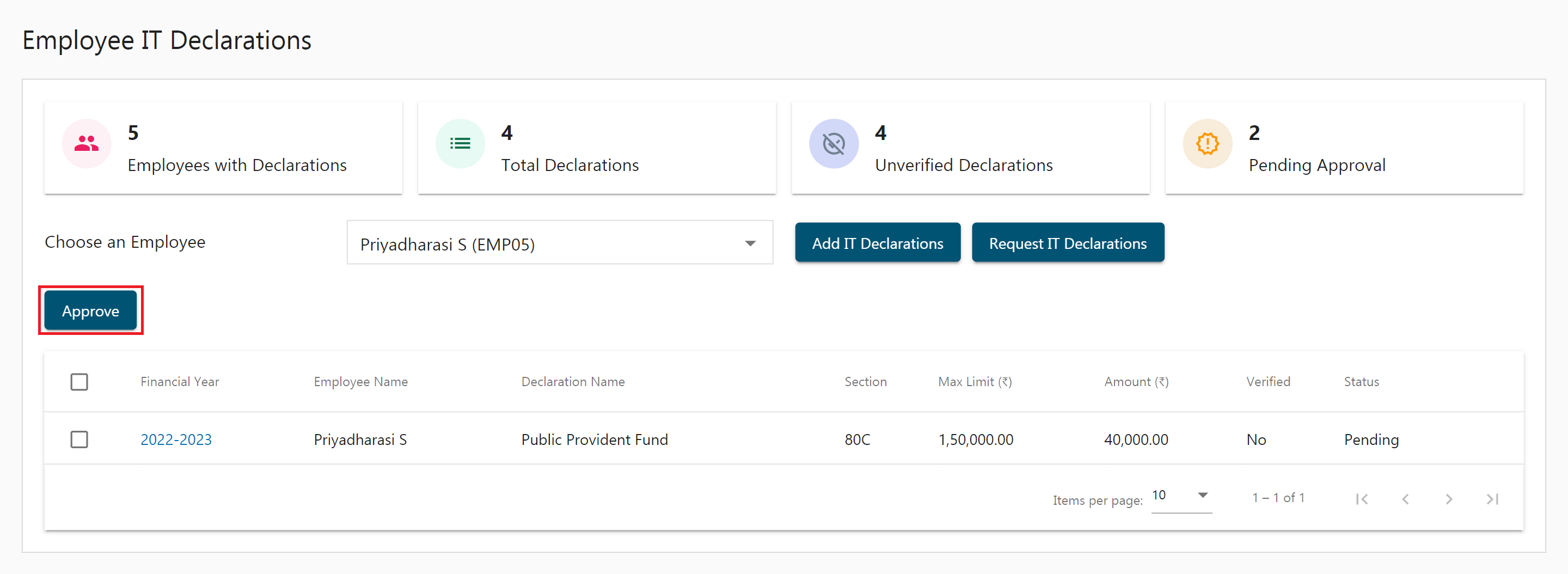

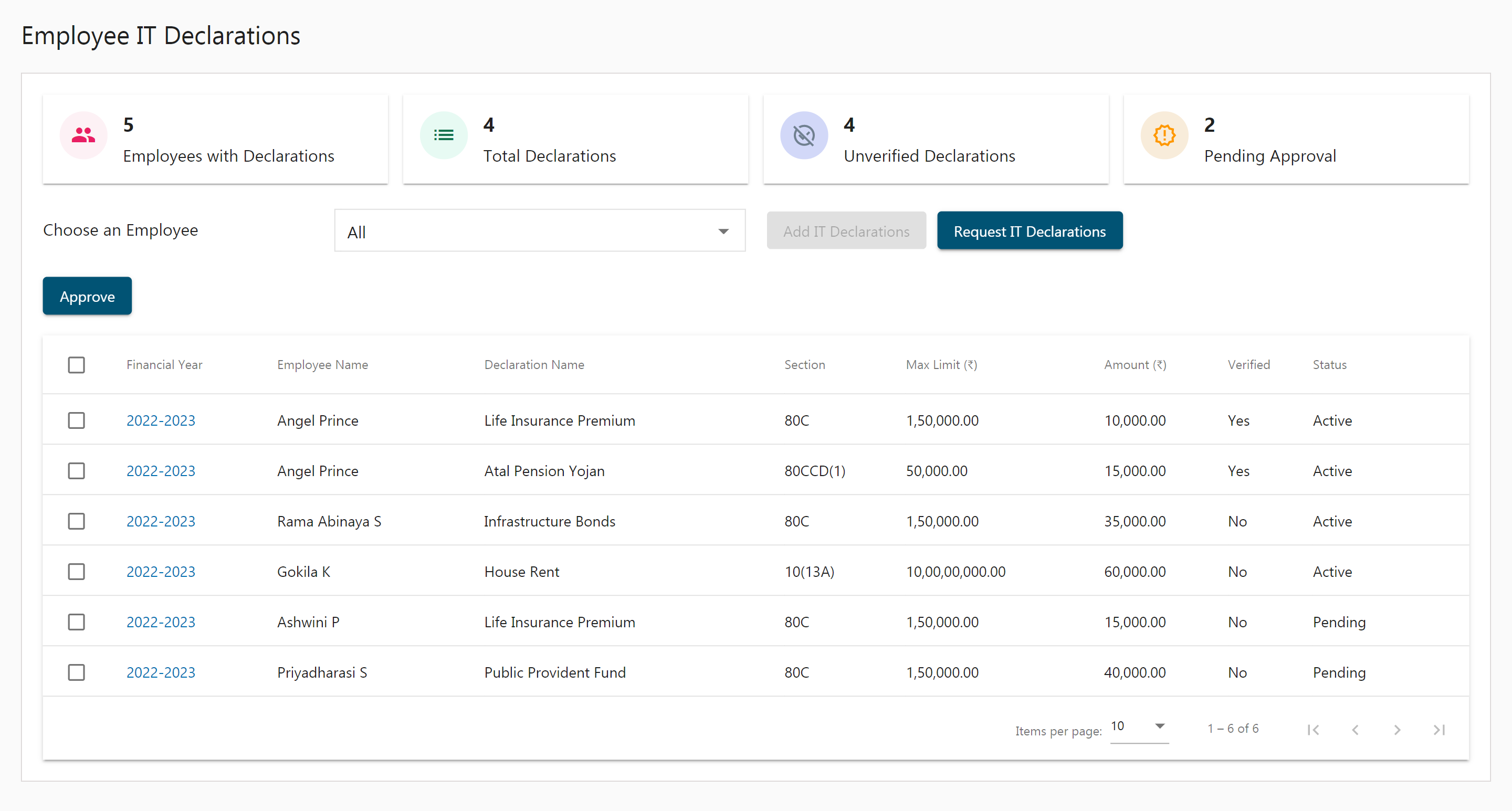

In the IT declaration dashboard, the super admin can view the summary of Employees with the Declarations, Total Declarations, Unverified Declarations, and Pending Approvals.

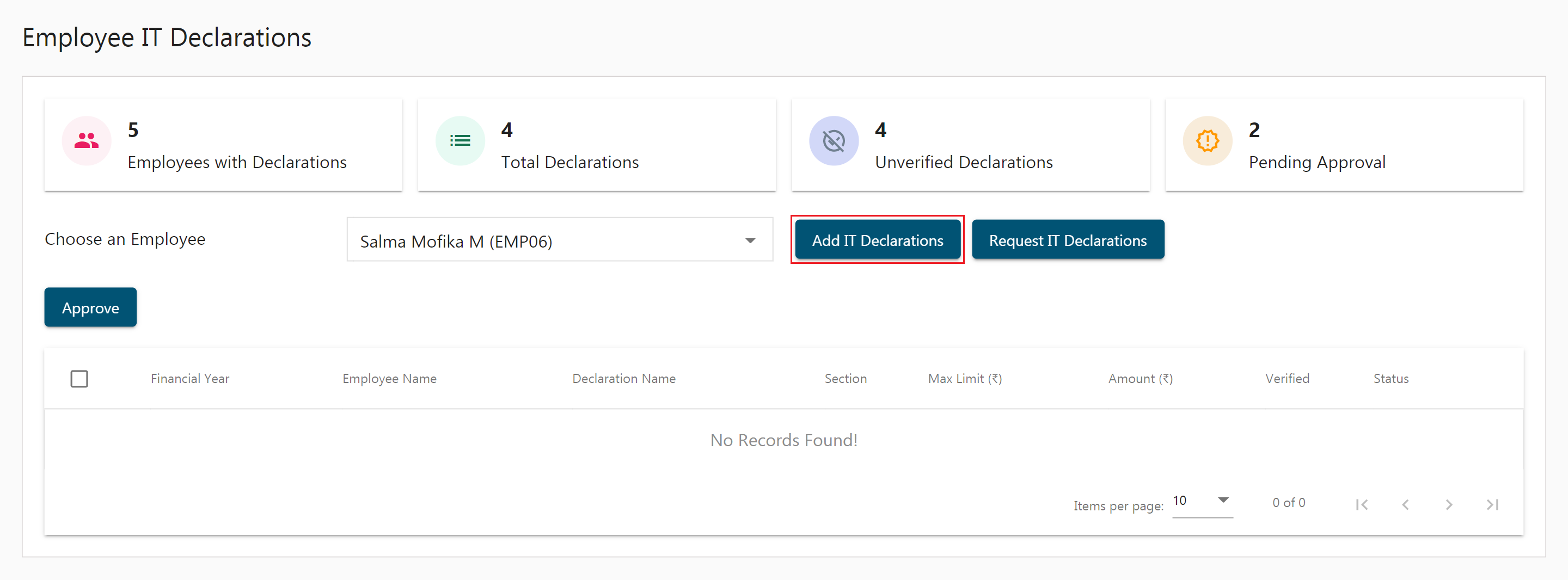

Employees can submit their IT declarations directly from the employee portal. For those employees whose employee portal has not been enabled, their IT declarations may be submitted from the super admin account.

- Choose the Employee name for whom you are going to add IT Declaration.

- Click on Add IT Declaration.

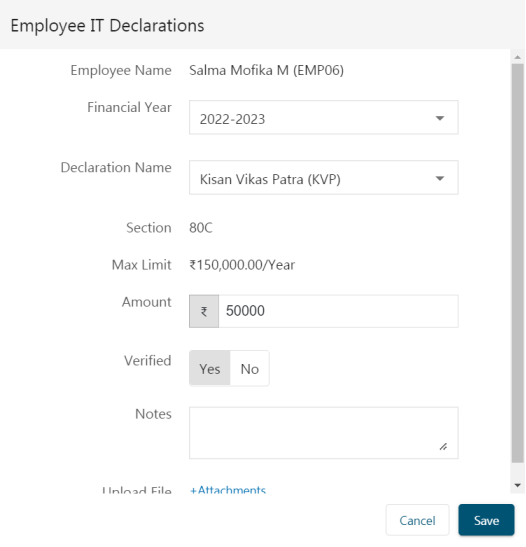

- In the Employee IT Declaration pop-up, mention the financial year, add the declaration name, the IT section and the maximum limit amount will be added based on the chosen declaration. Then add the amount, verification details, notes, and upload documents if any by clicking on the +Attachments link.

- Click Save.

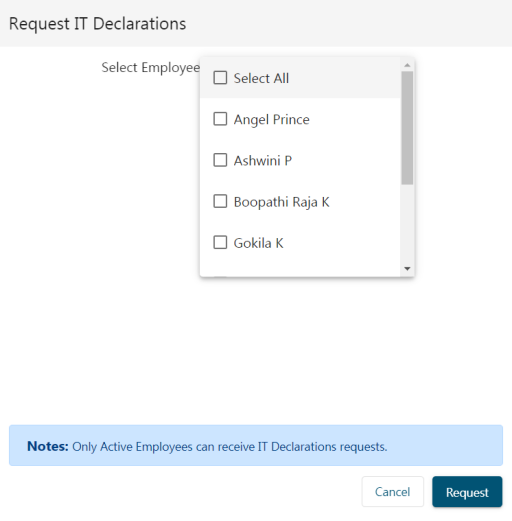

- Also, you can request an employee to submit their IT declaration, by clicking on the Request IT declarations button.

- Select employees from the checklist and click on Request to send IT declaration emails.

- When you want to approve requests, select the employees from the list and click on the Approve button.