Payroll settings consist of three tabs:

- Pay Period

- TDS Config

- Rounding Amounts

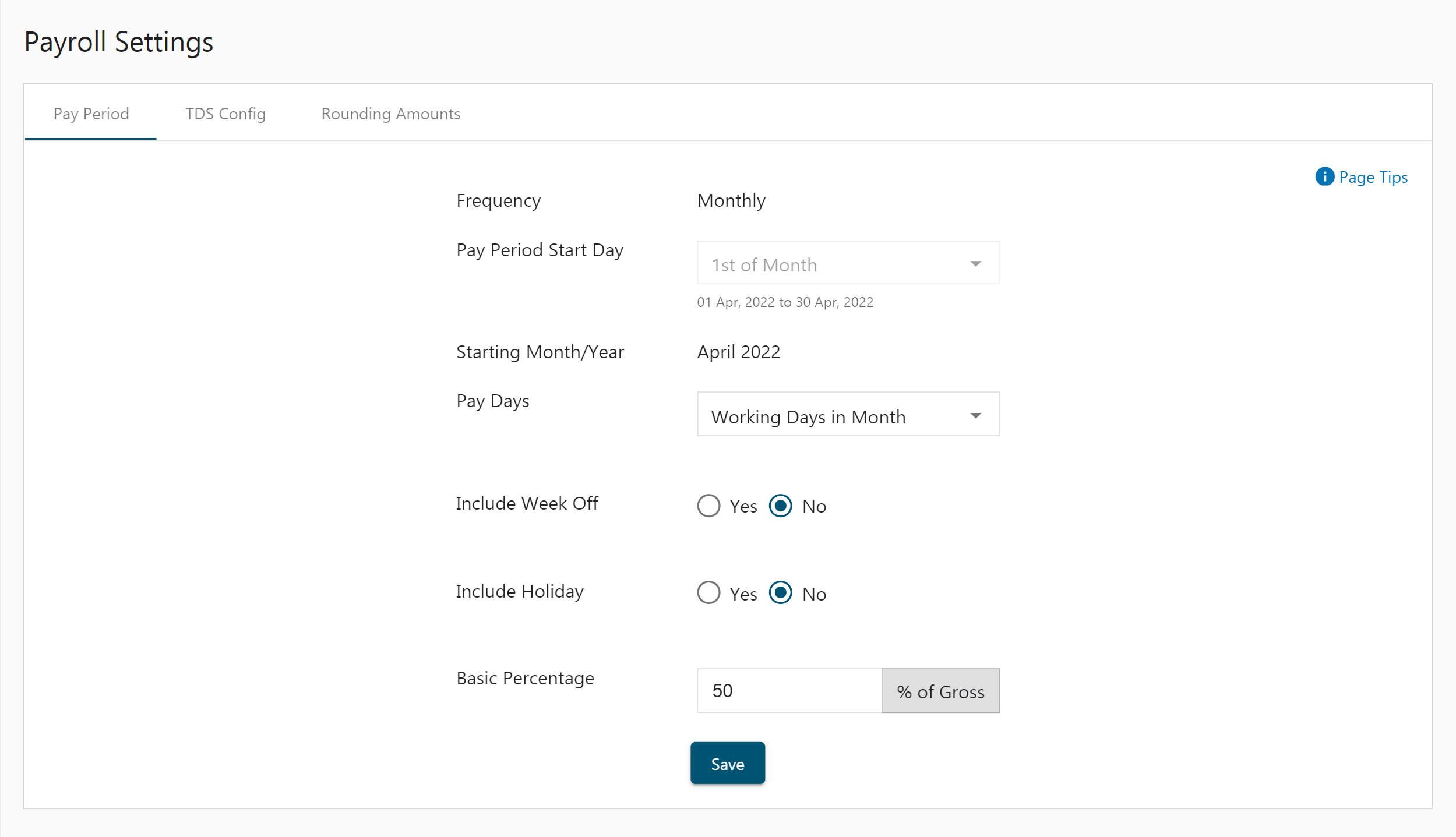

Pay Period

A pay period is the recurring time frame during which an employee’s work hours are tracked and paid. For example, 1st of a month to the 30th of the month. So salary is calculated depending on the employee’s working time during this pay period. Your employees will be paid once every pay period.

Payroll Settings in Zenyo Payroll

- Start by switching to Payroll Settings under Settings.

- The Frequency by default is set to Monthly.

- Choose the Pay Period Start Day i.e, 1st of the month, 2nd of the month, etc.

- Choose Pay Days. There are two options to choose from- Working Days in a Month and Actual days in a Month.

- If Paydays is set to Working Days in a Month - Salary is calculated based on only the working days excluding the week offs.

- If Paydays is set to Actual Days in a Month - Salary is calculated based on the total number of days in a month.

- Choose whether you want to include week-offs and holidays in the working days while calculating the pay using the Yes/No radio buttons.

- Click Save and move on to the TDS config tab.

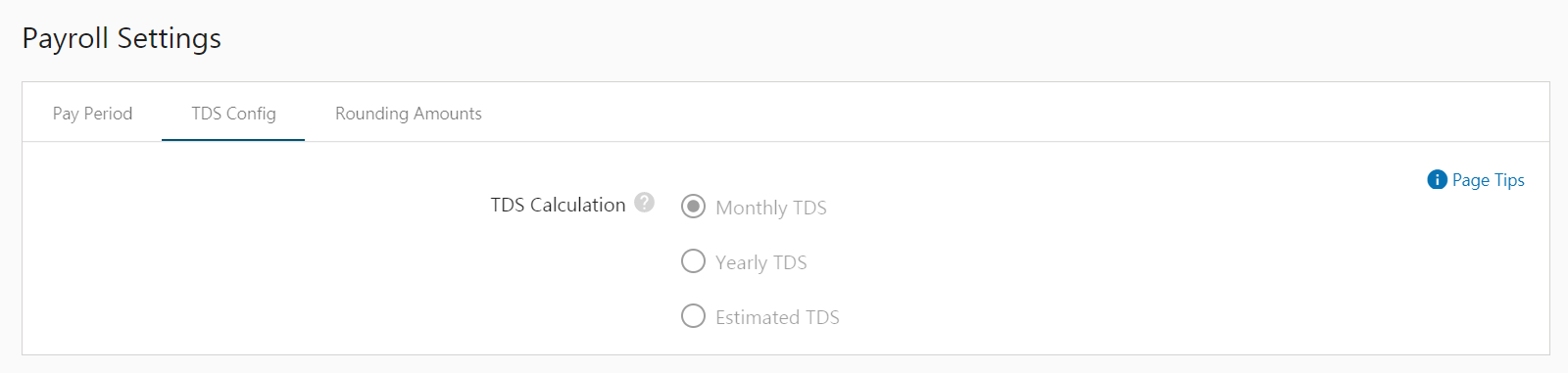

TDS Config

Tax Payment Frequency is the frequency with which you deposit your Tax Deducted at Source (TDS) to the Income Tax Department. Your tax payment frequency is set as monthly by default. If your business follows a different tax payment frequency, write to us at support@zenyopayroll.com and we’ll enable it for you.

Based on your preference, you can configure TDS settings as either Monthly, Yearly or Estimated TDS for Custom Option.

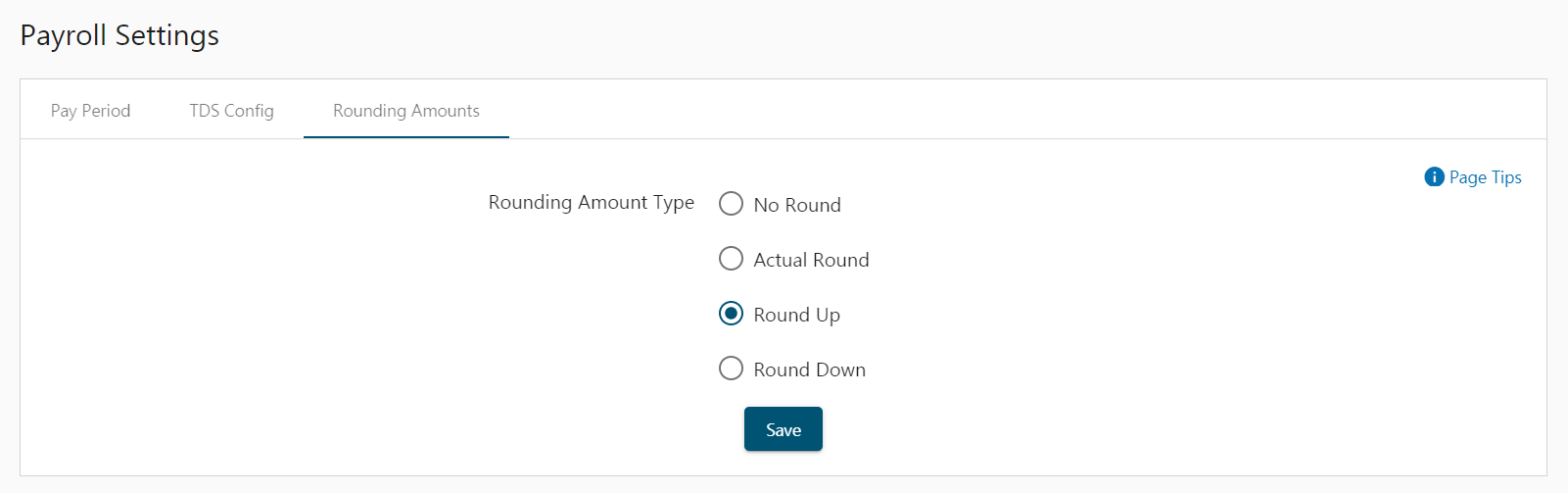

Rounding Amount

Move on to the Rounding Amount tab and choose Round amount Type. There are four options to choose from.

- No Round No Round means amounts are not rounded.

- Actual Round Actual Round means Gross, TDS, Net and Cess, Allowances, Deductions and Surcharge amounts will be rounded as illustrated in the following example. Suppose the amount is 1.5 or greater than 1.5 and less than 2 then it is rounded as 2. If the amount is below 1.5 then it is rounded as 1.

- Round-Up Round-Up means Gross, TDS, Net and Cess, Allowances, Deductions and Surcharge amounts will be rounded as illustrated in the following example. Suppose the amount is greater than 1 and less than 2 then it is rounded as 2.

- Round Down Round Down means Gross, TDS, Net Amount and Cess, Allowances, Deductions and Surcharge amounts will be rounded as illustrated in the following example. Suppose the amount is greater than 1 and less than 2 it is rounded as 1.