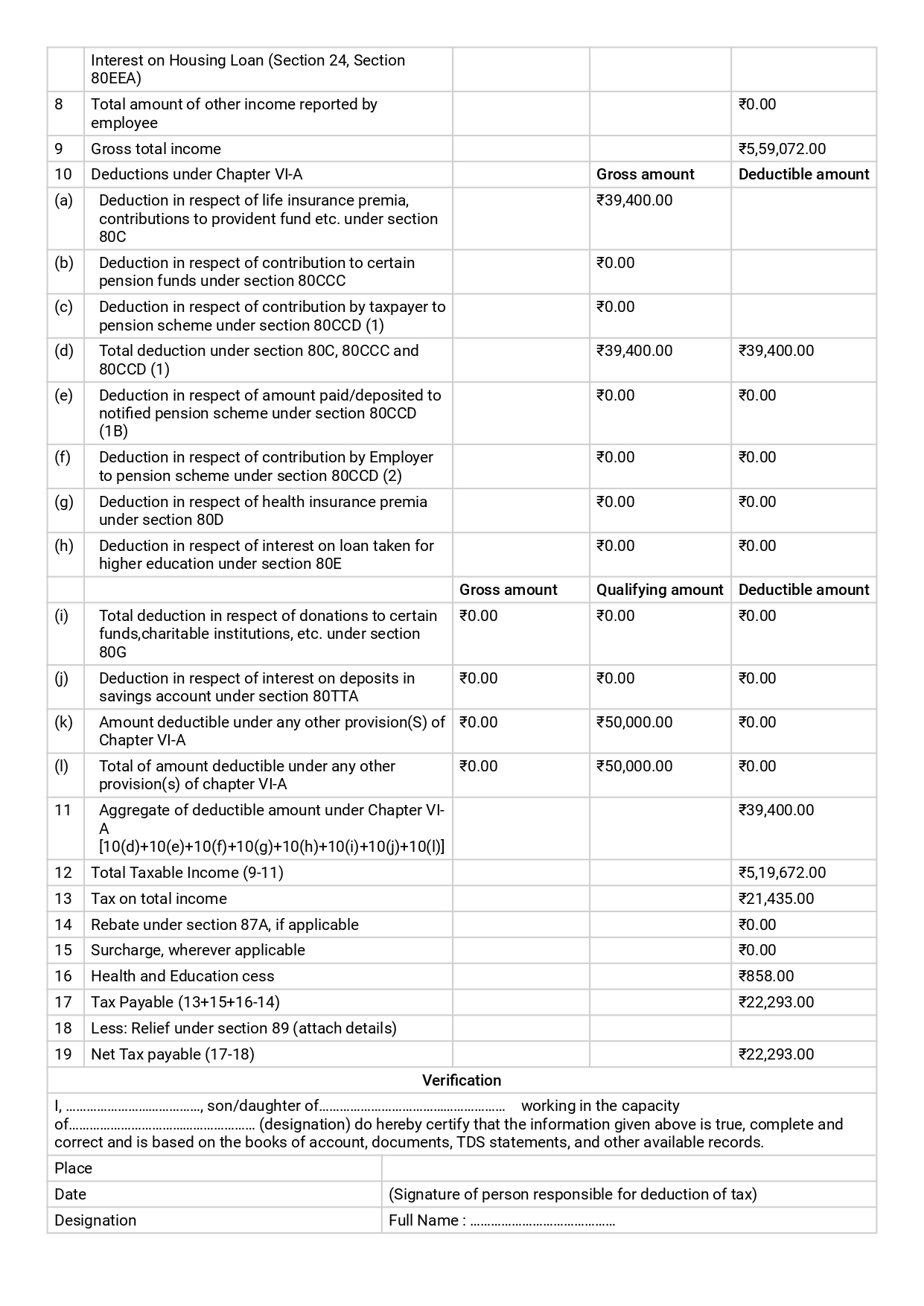

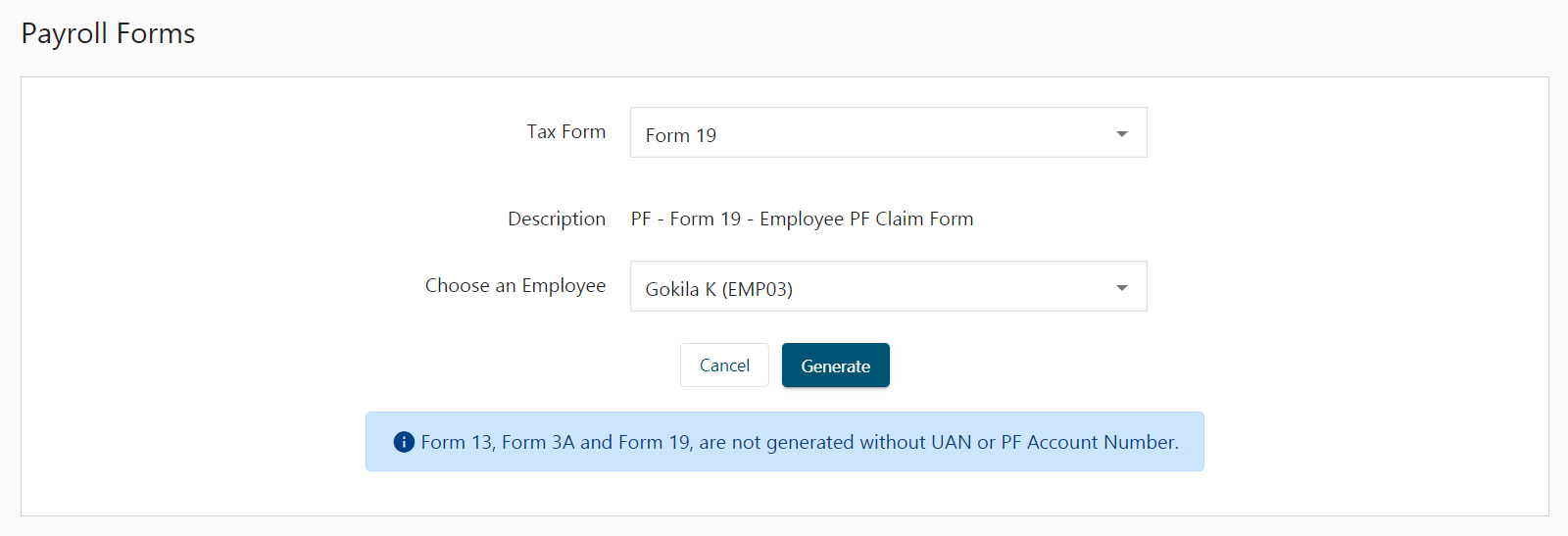

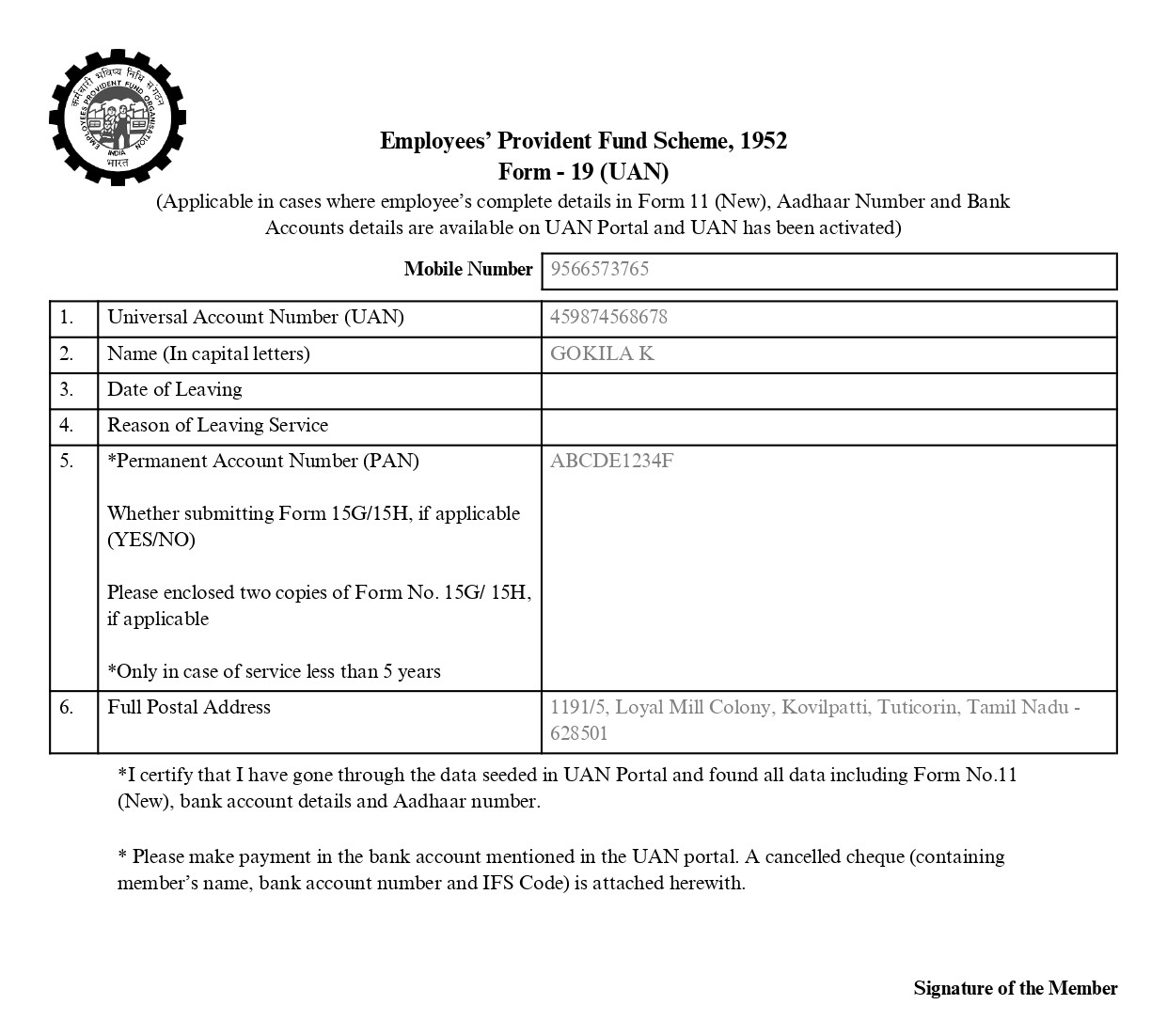

Form 19

When a member wants to close down his or her PF account, PF Form 19 must be completed. It is just for employees who do not have a Universal Account Number (UAN). Without a UAN, PF Form No. 19 can be filled in, and the member will just need to provide his or her PF account number.

The Zenyo Payroll platform allows you to generate necessary forms to run payrolls effectively.

Click Generate to get the corresponding forms.

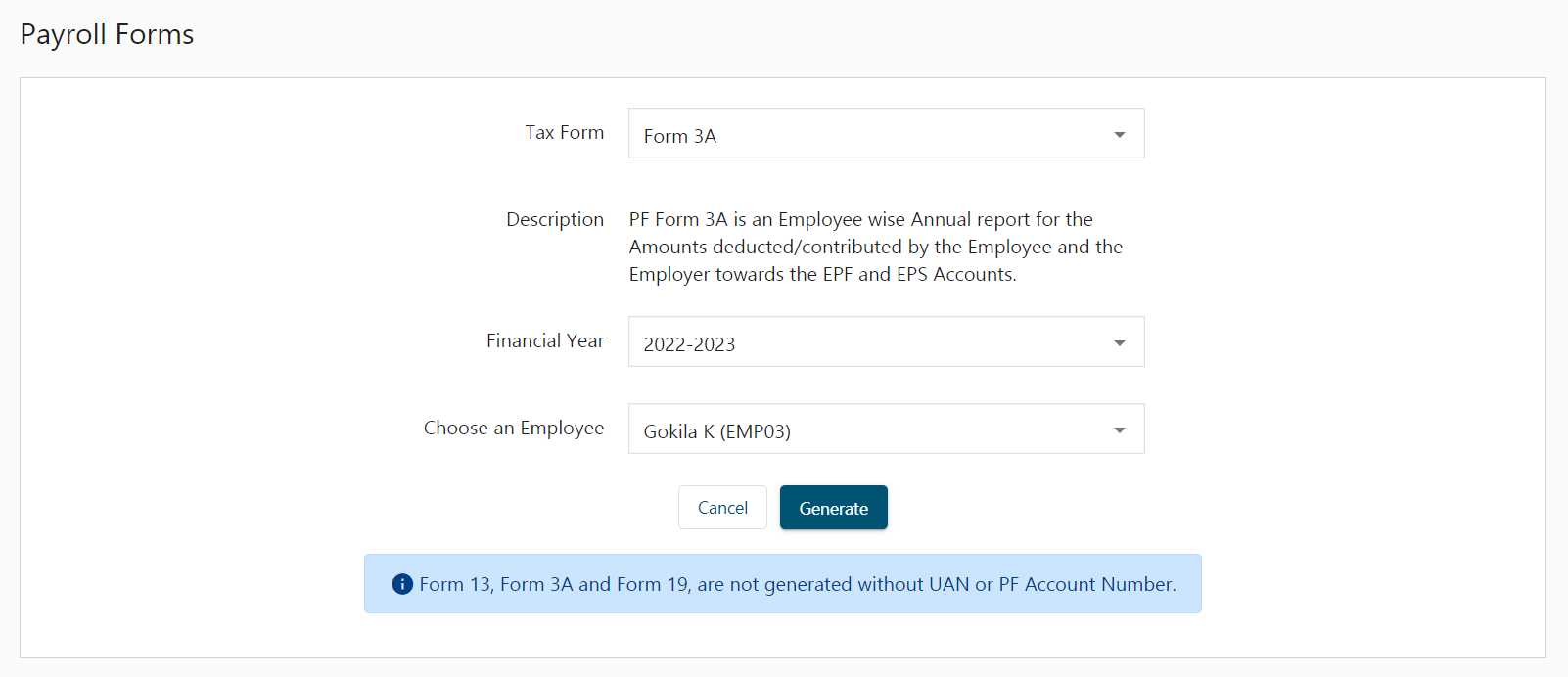

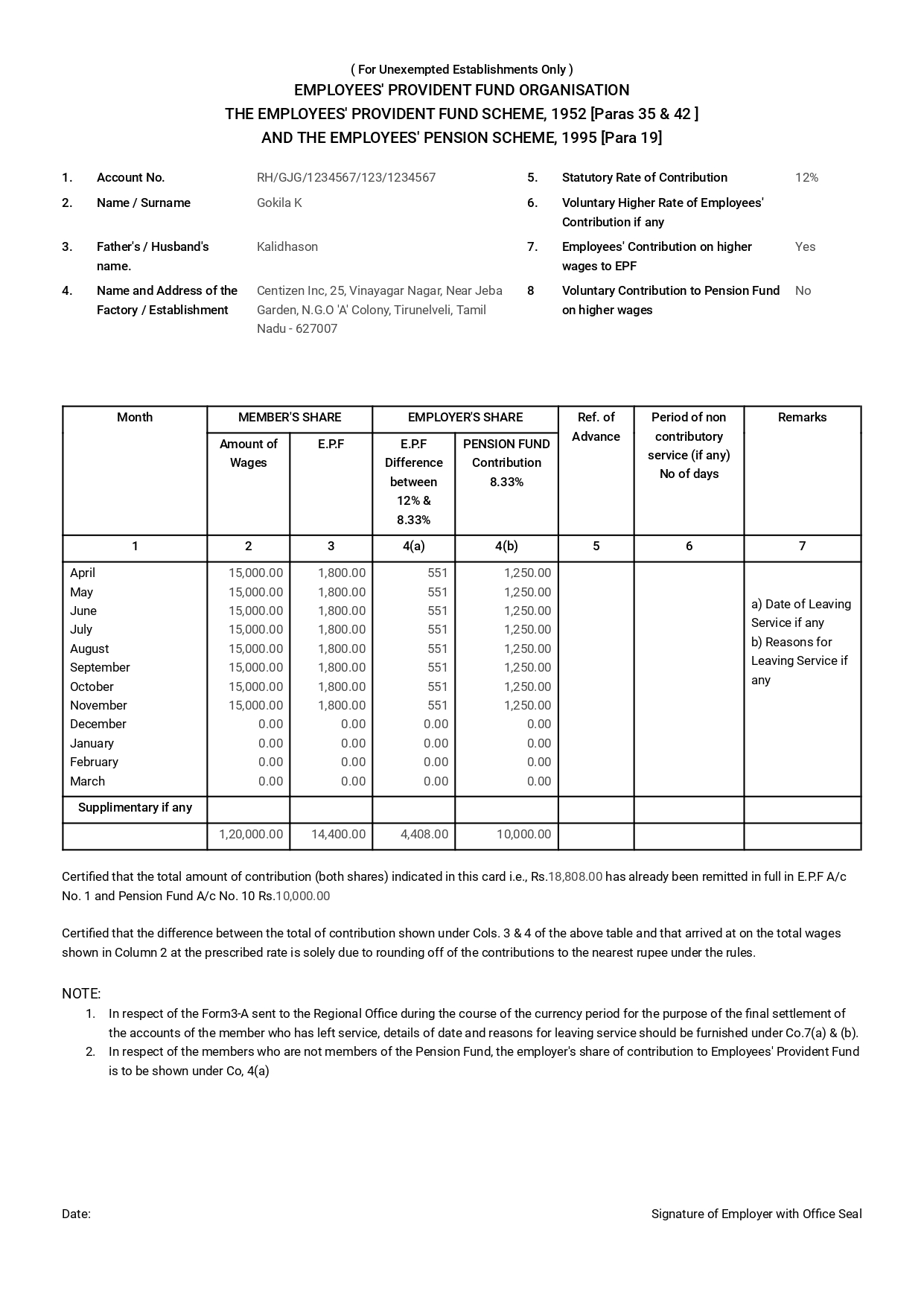

Form 3A

Form 3A also known as the employee’s annual contribution card, is a record of monthly contributions made by him/her towards EPF and PF for a financial year.

Clicking on the Generate button.

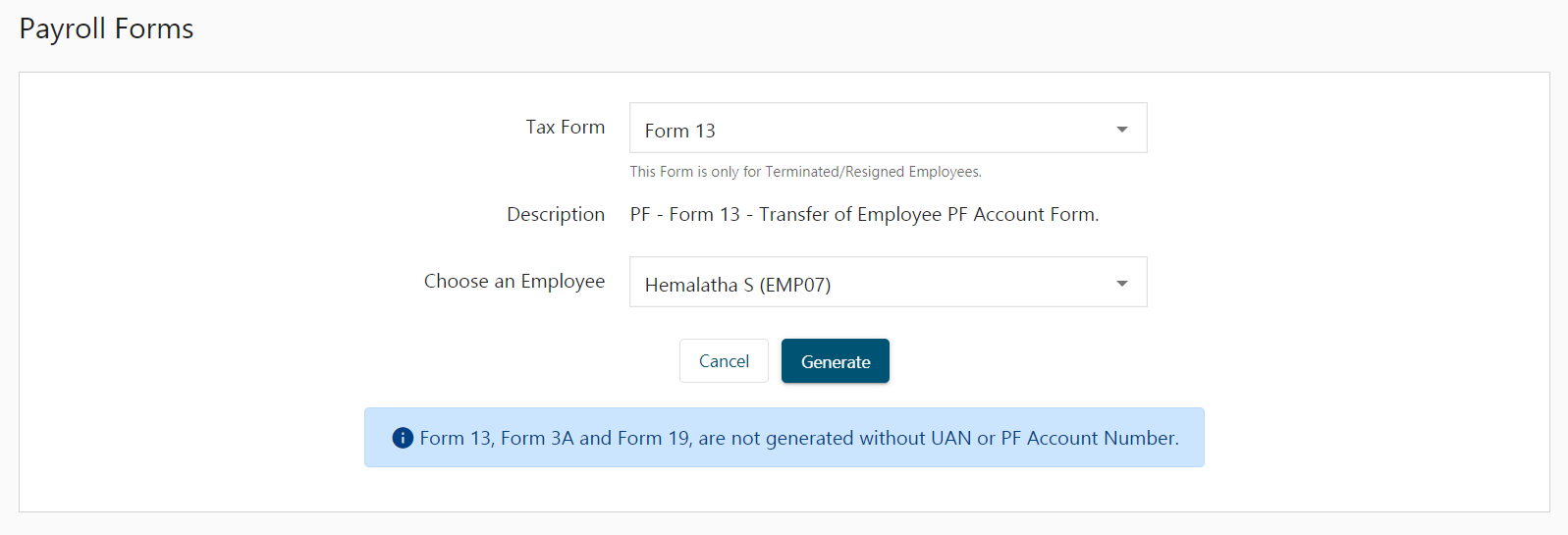

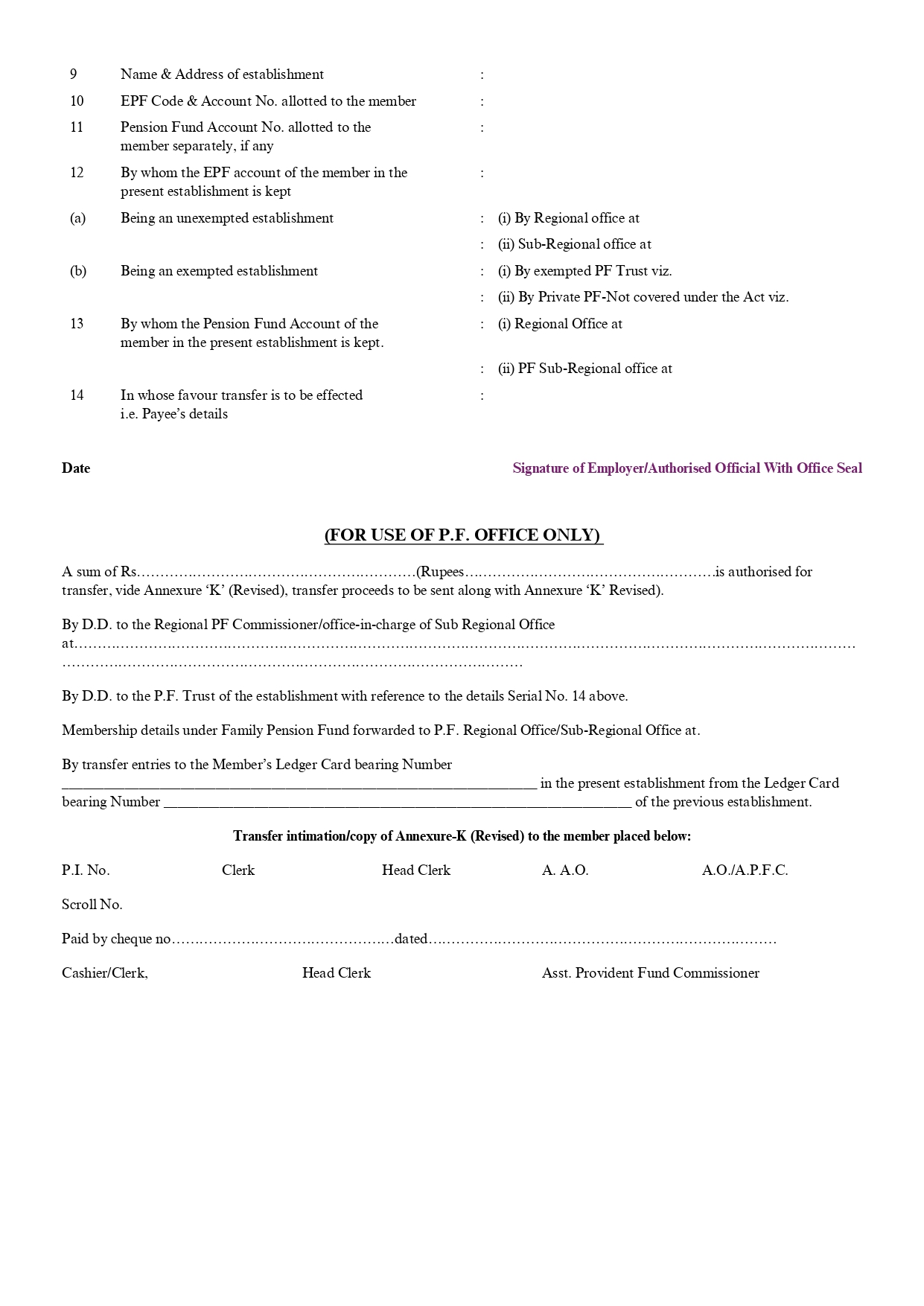

Form 13

If the previous account was managed by the exempted establishment’s PF Trust, a transferring employee must fill out a Transfer Claim Form.

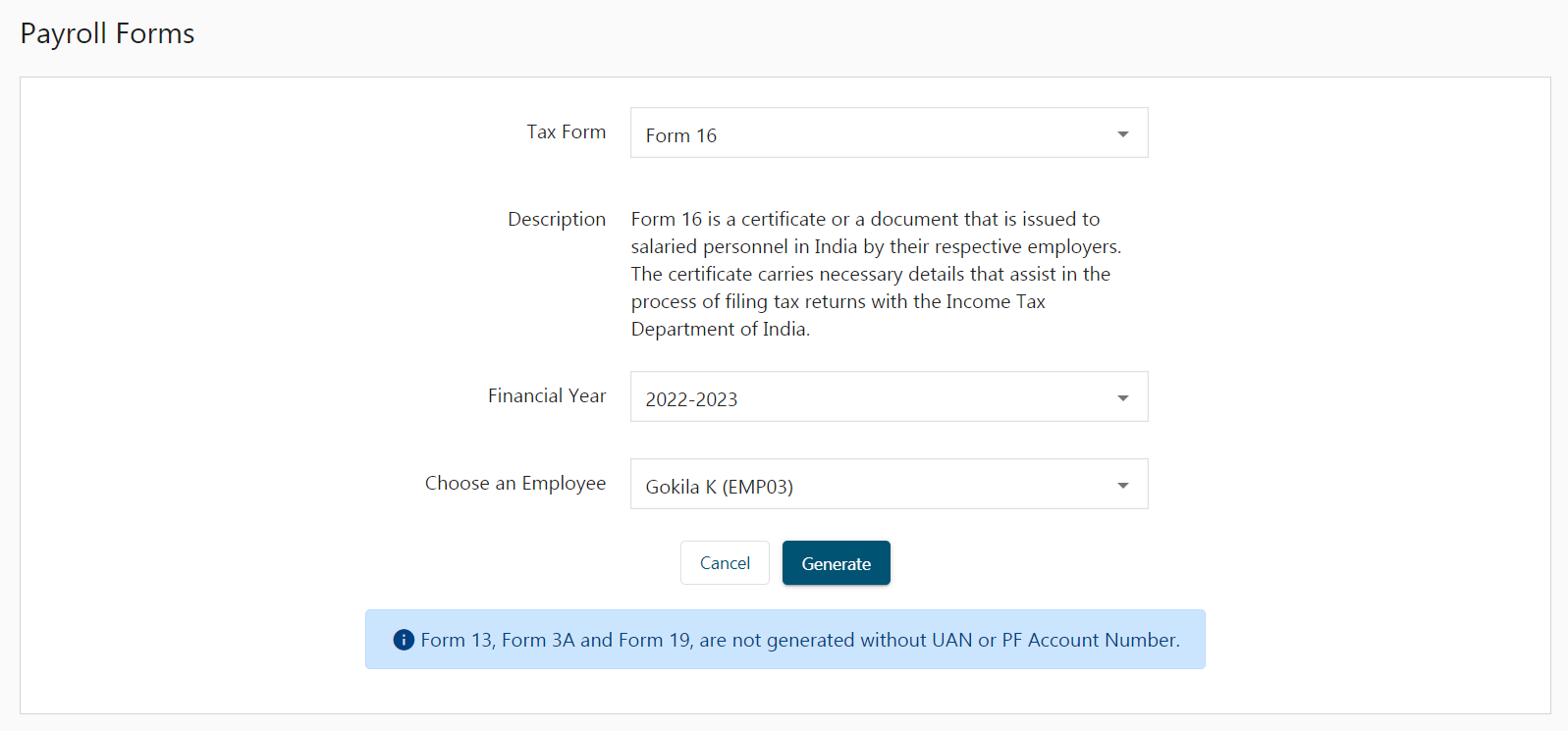

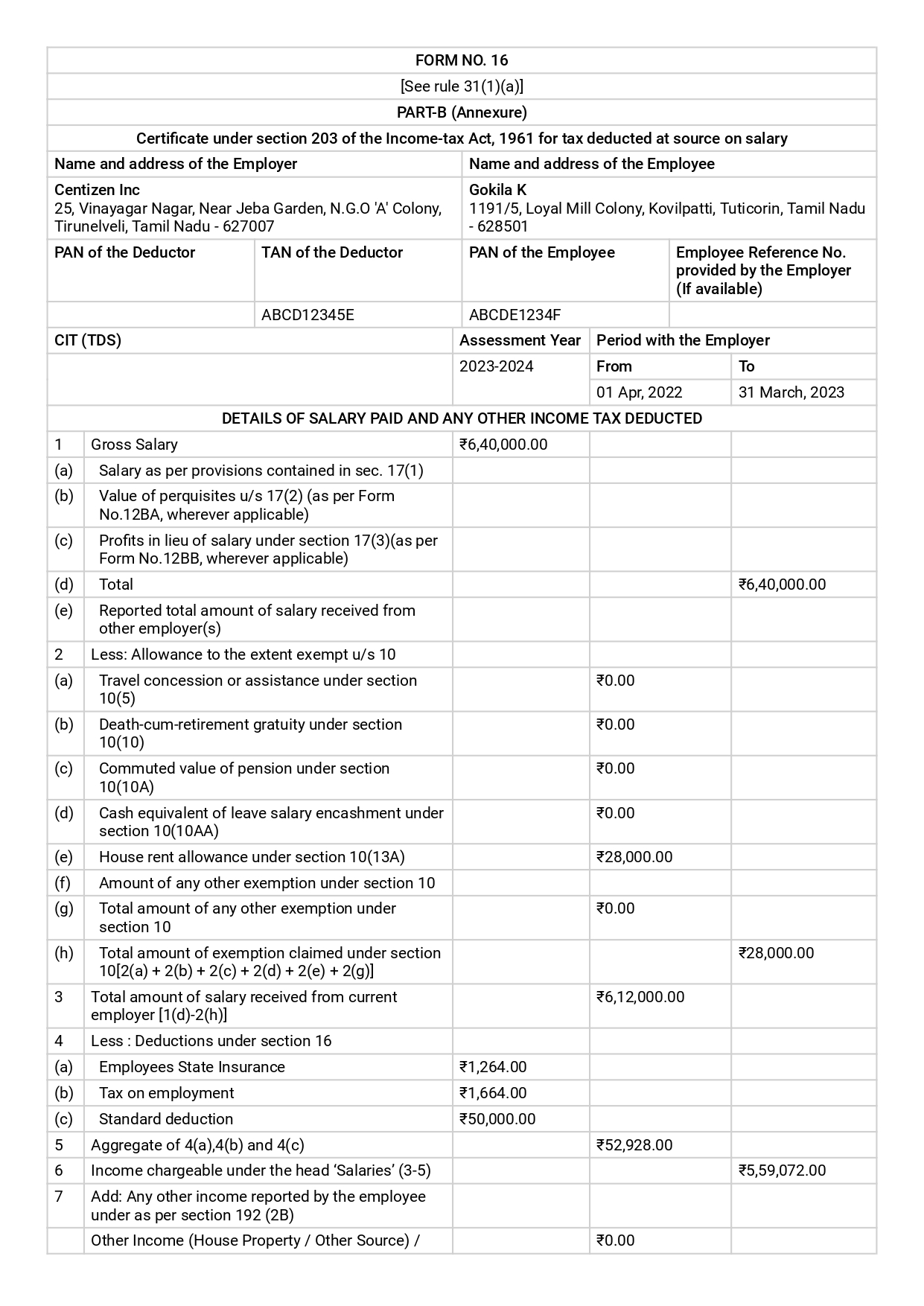

Form 16

Form 16 is a TDS Certificate issued by employers that brief employees of their taxables and paid to the government. Form 16 helps employees what they have paid and what is due for payment.