The Advances and Loans module in Zenyo Payroll lets you sanction loans and deduct loan repayments of all the loans that you’ve provided to your employees. Repayments of fixed amounts can be done by employees every month and manual repayments can also be recorded.

Manage Loans

- Choose the Advances/Loans menu from the sidebar

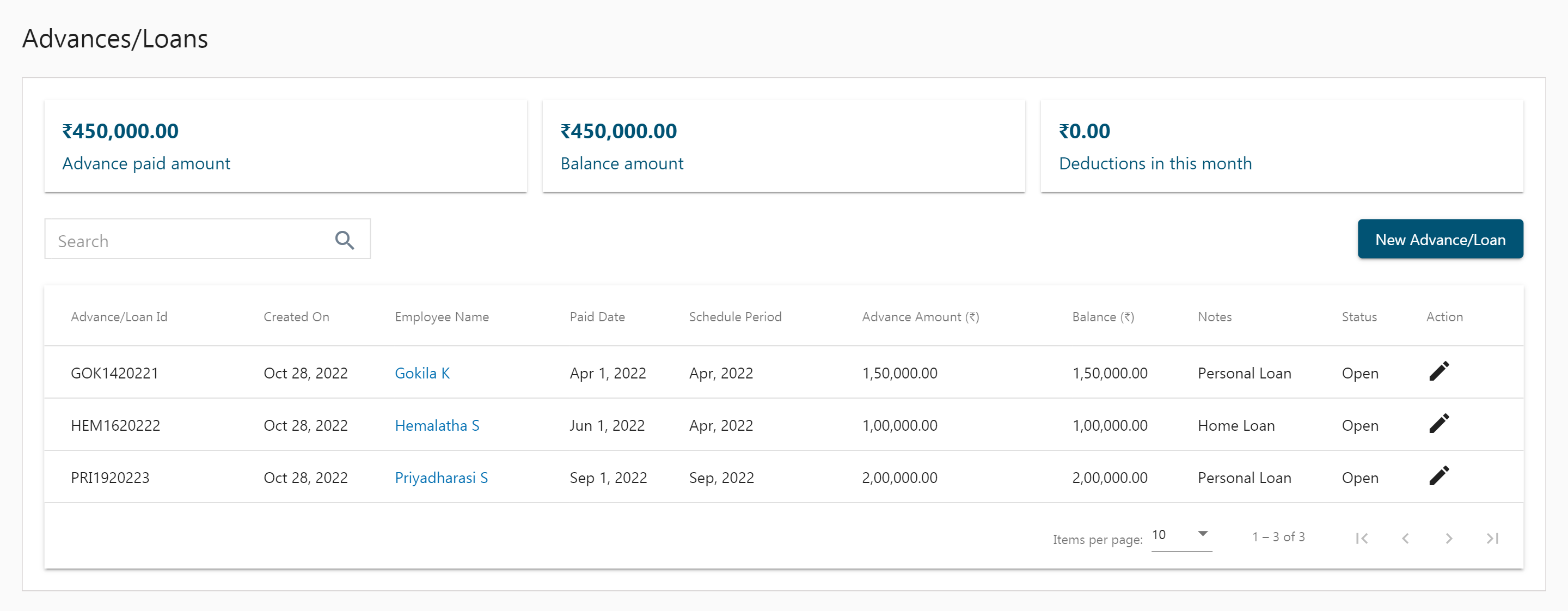

- The Advances/Loans page displays the Advance paid amount, Balance amount, and Deductions for this month.

- It also displays the list of all the loan details provided to the employees. Details include Loan Id, Date on which loan was sanctioned, Employee name, the date on which the employee was given the loan, Schedule period, Loan amount, Balance amount to be paid, and Loan status. Status includes three stages viz, open (outstanding loan amount yet to be repaid), void (loan canceled), and closed (loan repaid).

- You may edit the loan details by clicking on the edit icon.

Add New Loans

- Choose the Advances/Loans menu from the sidebar.

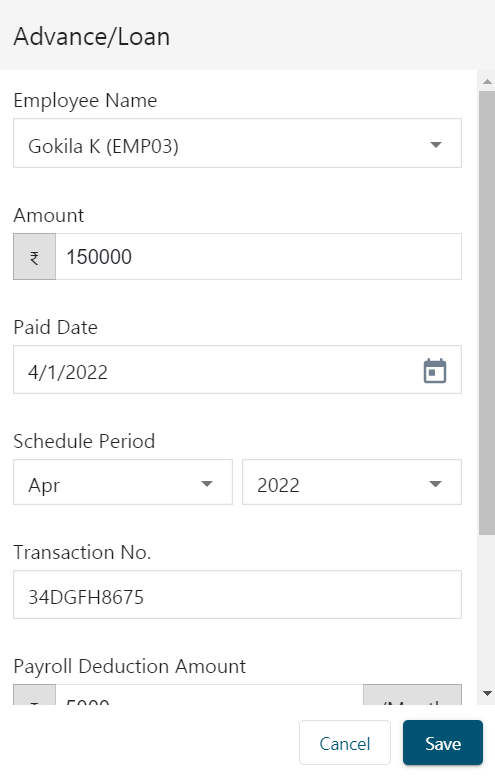

- Click on the New Advance/Loan button.

- Enter the Employee Name, Loan amount, Paid date, Repayment schedule period, Transaction number, deduction amount per month, and notes.

- Click on Save.

View Advances/Loans details of an employee

- Choose the Advances/Loans menu from the sidebar.

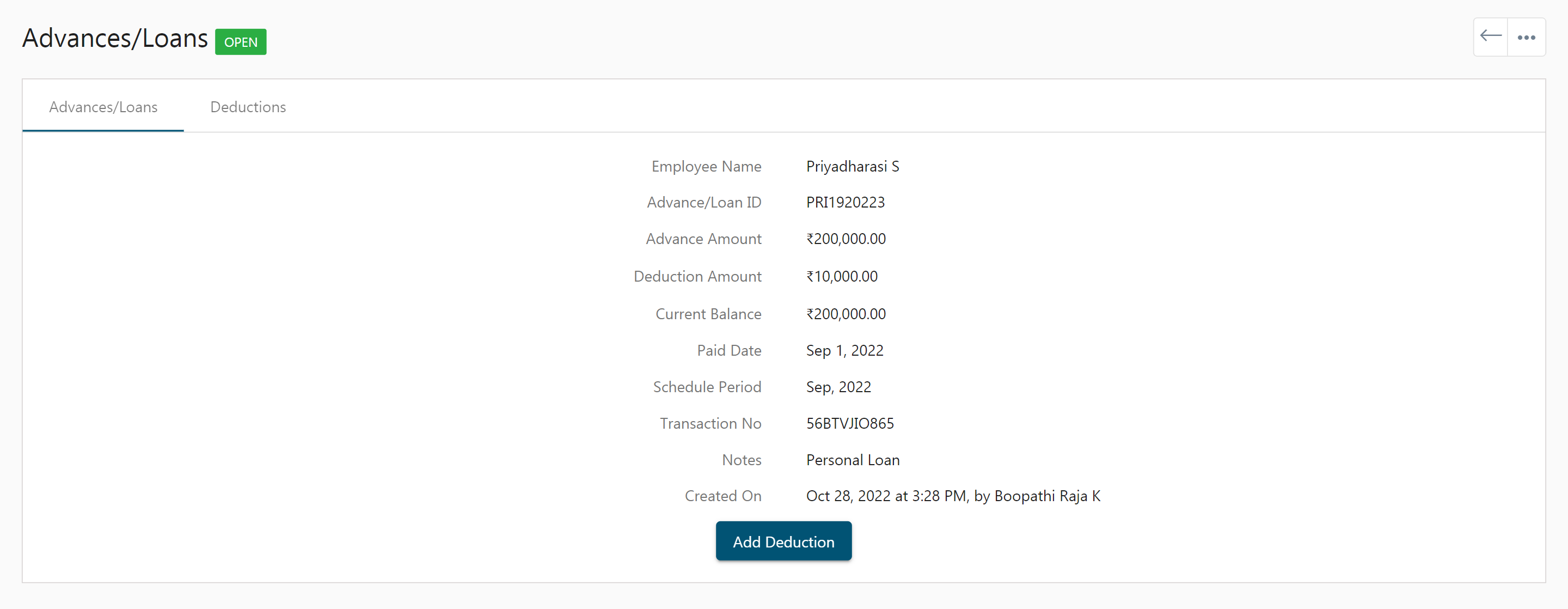

- From the list of loans click on a particular employee name.

- Click on the Advances/Loans tab to view all the details concerning the loan of a particular employee.

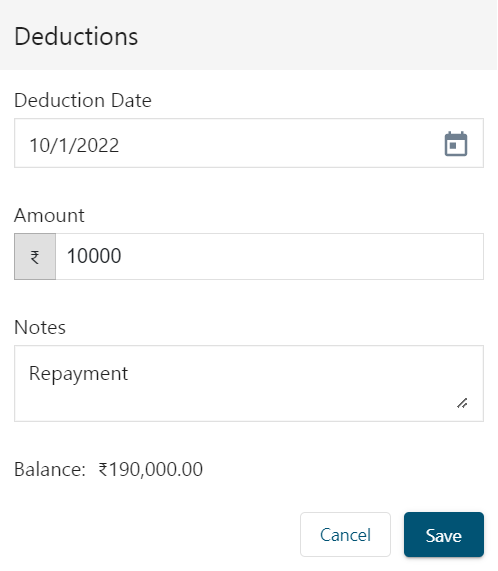

- Click on the Add deduction button to record details of repayment.

- Enter the Deduction Date, Amount, and notes.

- Click Save.

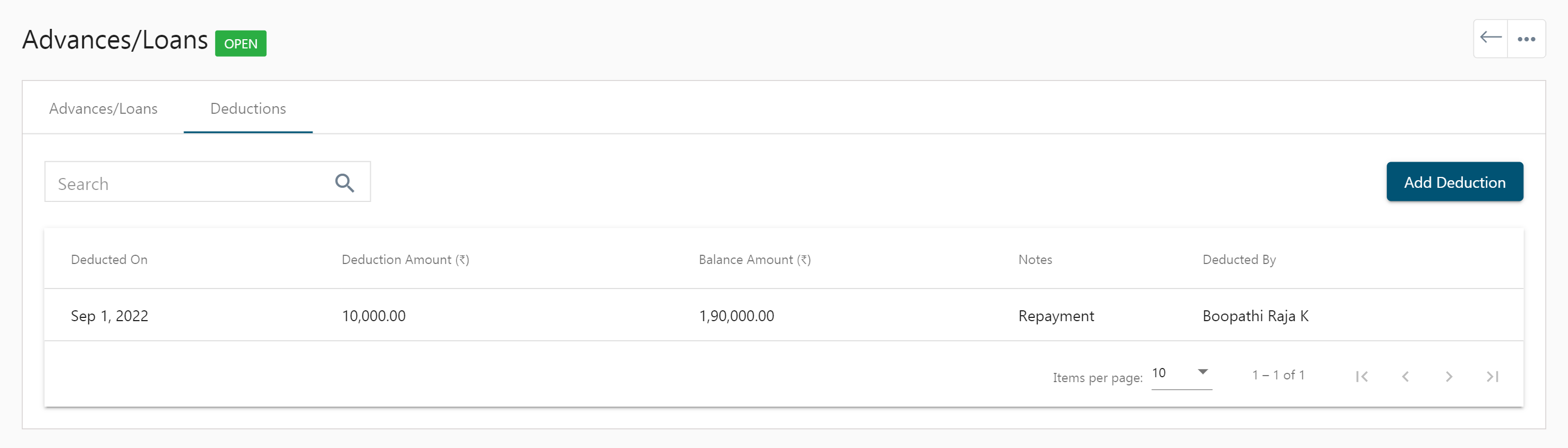

- Click on the Deductions tab to view all the details of the loan repayment like the Date of deduction, Deducted amount, and the balance to be paid.

- Click Save.