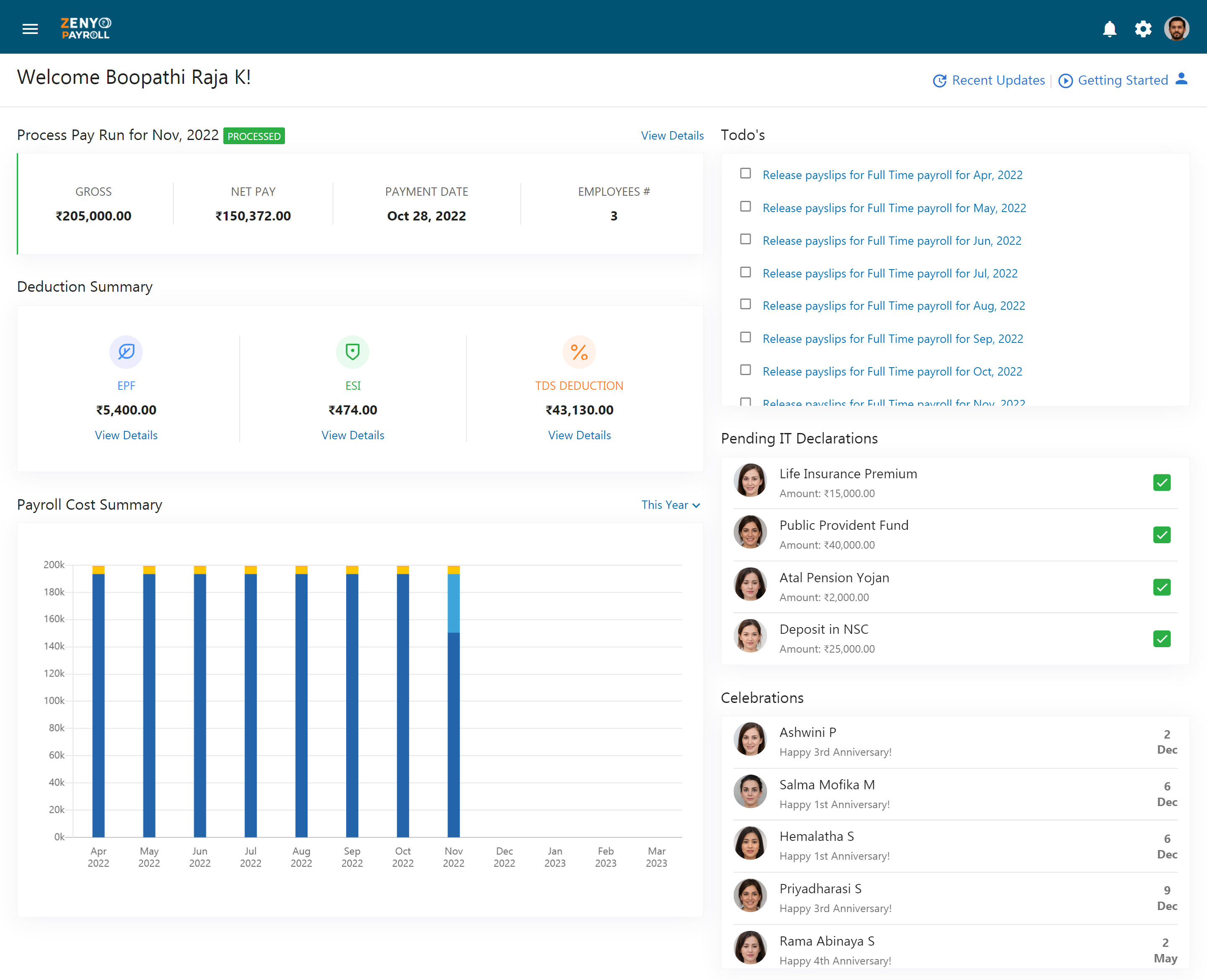

When you’ve signed in to the Zenyo Payroll, the first thing you’ll view is your dashboard.

The dashboard includes 2 sections:

- Company Dashboard

- Employee Dashboard

Company Dashboard

The company dashboard will display all the payroll and employee related details in the company.

The company dashboard has the following section:

- Process Pay Runs

- Deduction Summary

- Payroll Cost Summary

- To-Do Tasks

- Pending IT Declarations

- Celebrations

- Upcoming Holidays

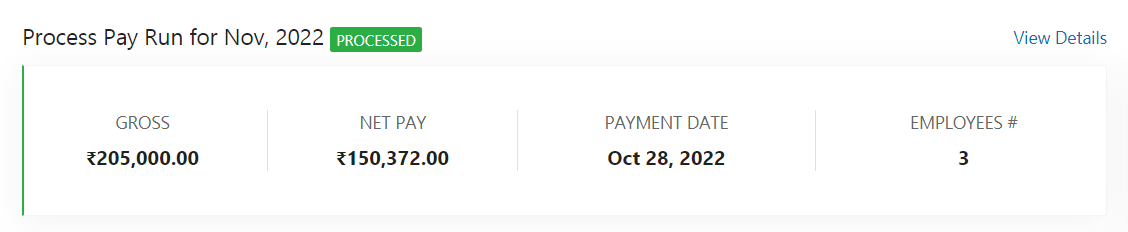

Process Pay Runs

The Process Pay describes the current or past pay runs, including the Gross Pay, Net Pay, Payment Date, and Total Employees.

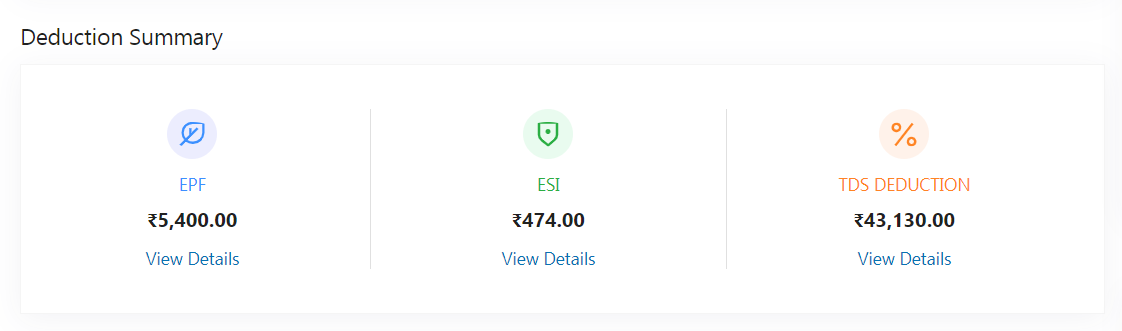

Deduction Summary

The deduction summary gives you information about Employee Provident Fund (EPF), Employee State Insurance (ESI), and Tax Deducted at Source (TDS) deductions for the most recent month. This is the contribution you paid to the Government. Clicking on the View Details link will lead you to the respective deduction report.

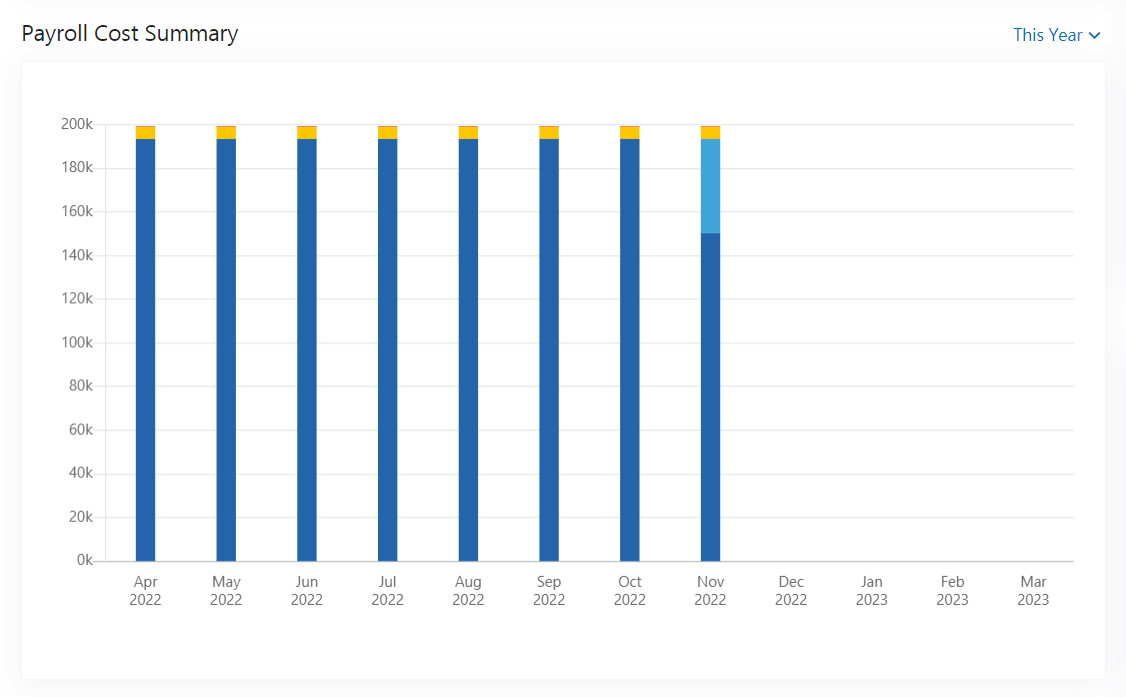

Payroll Cost Summary

The payroll cost summary helps you to analyze the money you have spent on running payroll for your organization. These graphs clearly explain the Net Pay (Amount paid to employees), Taxes (paid to the Income Tax department), PF (contributed toward pre-tax deductions), and ESI (employee benefit).

To-Do’s

The to-do’s in Zenyo Payroll acts as a reminder to the super admin to release payslips of processed payrolls, and process newly created pay runs.

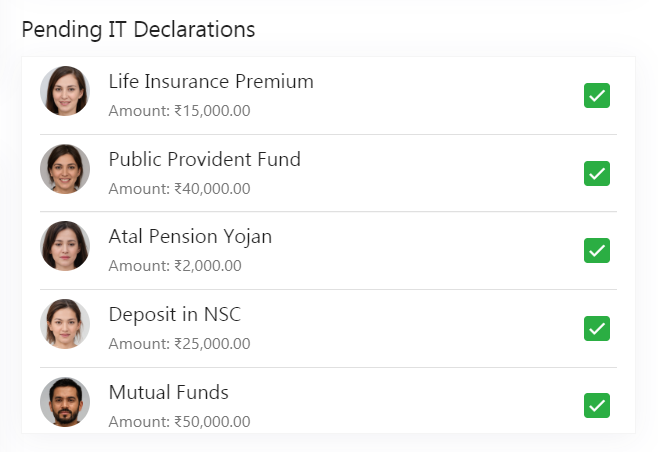

Pending IT Declarations

The pending IT declarations display the list of those IT declarations submitted by the employees waiting for approval. When the admin reviews and approves the IT declaration of the employee, it’ll be added to the IT declarations panel.

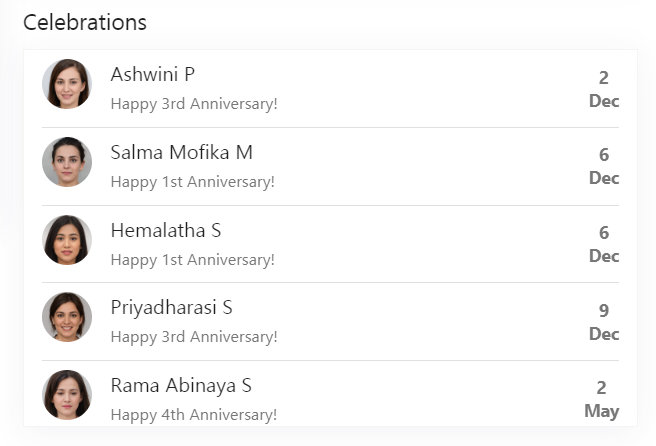

Celebrations

The upcoming birthdays and work anniversaries of the employees are listed with the respective dates.

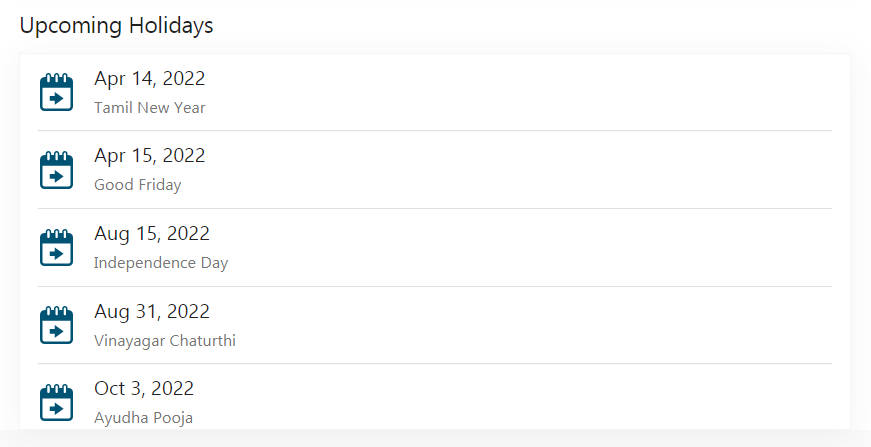

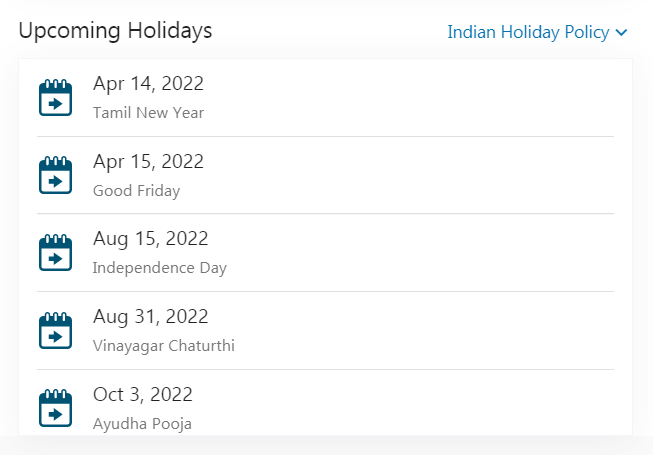

Upcoming Holidays

The upcoming holidays are listed in this tab and if you want to view other holidays click on the drop-down button. You can add a new holiday policy in company settings.

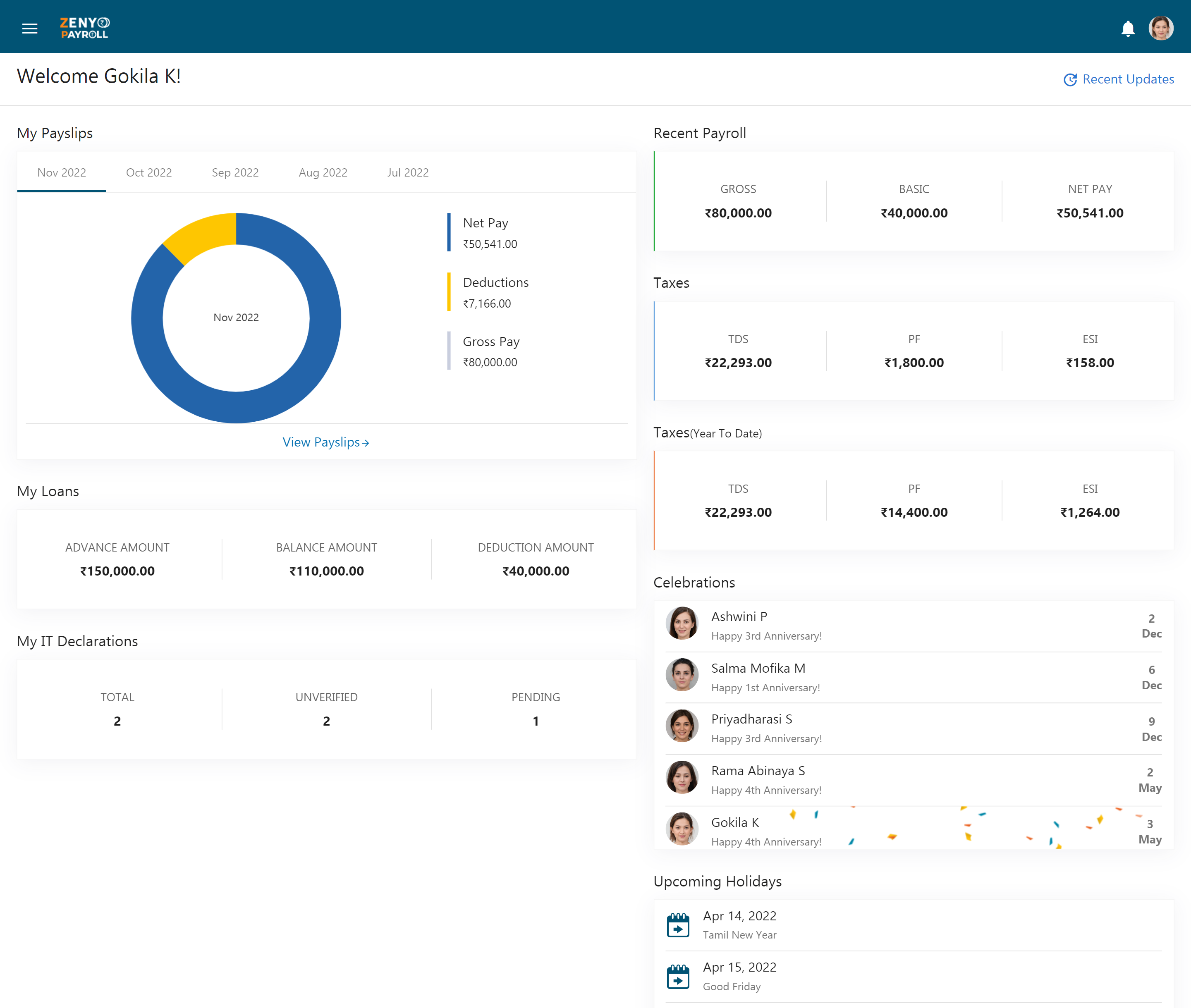

Employee Dashboard

The employee dashboard will display your payroll and information details.

The employee dashboard contains the following sections:

- My Payslips

- Recent Payroll

- Taxes

- Taxes (Year to Date)

- My Loans

- My IT Declarations

- Celebrations

- Upcoming Holidays

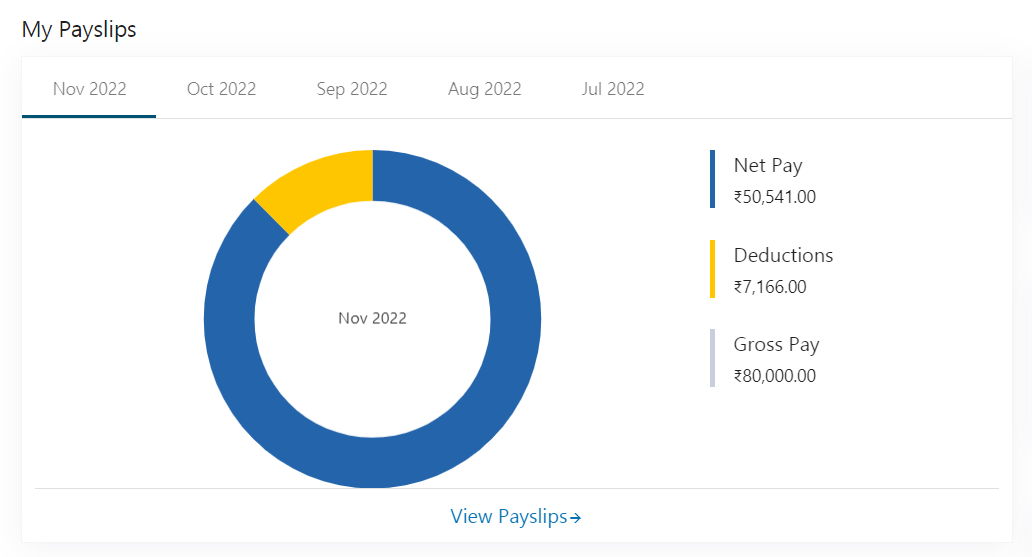

My Payslips

Employees can view all the payslips they’ve received each month, along with an overview of their Gross Pay, Net Pay, and Deductions. By clicking on the View Payslips link, employees can view the payslips for each month along with the breakup of salary components.

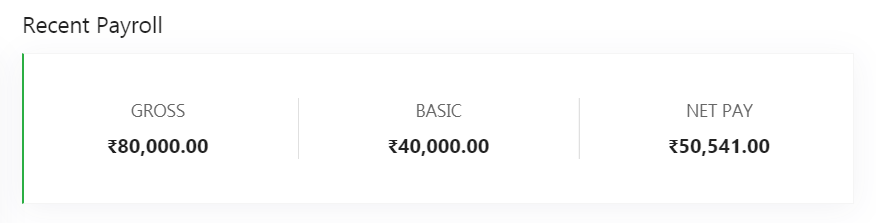

Recent Payroll

The recent payroll shows the last pay run along with the Gross pay, Basic pay, and Net pay.

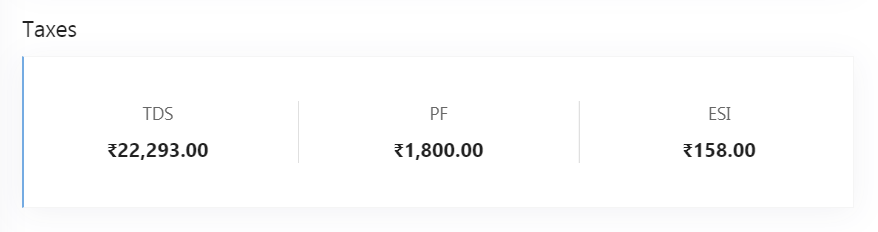

Taxes

The taxes section shows the break up of tax deductions like TDS, PF, and ESI in the last pay run.

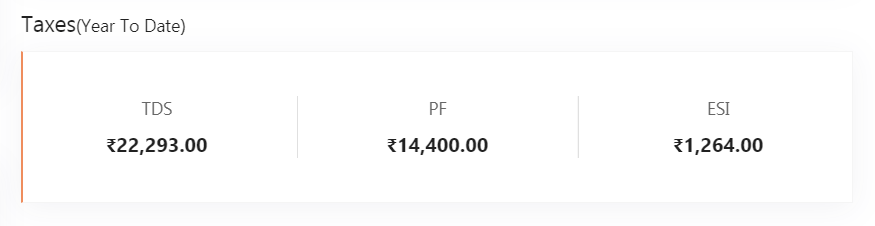

Taxes (Year to Date)

The taxes section shows the breakup of tax deductions like TDS, PF, and ESI from the start of the financial year to date.

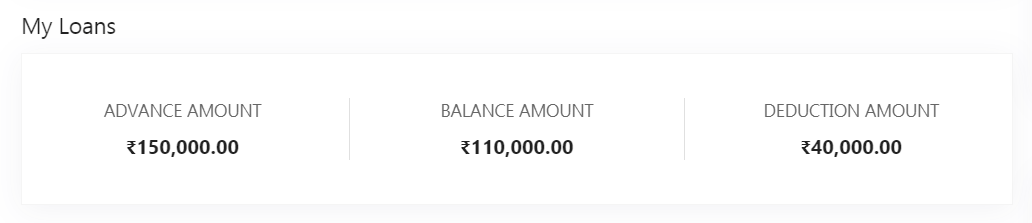

My Loans

Employees can keep track of all their loan details like Advance/Loan Amount, Balance Amount, and the Deducted Amount. However, employees cannot apply for loans from this page but can only view the details.

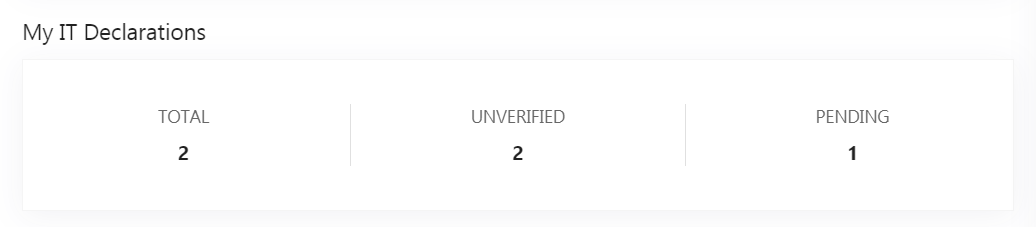

My IT Declarations

Employees can view the number of IT declarations submitted by them to reduce the Tax amount. They can also view the pending and unverified proof of investment.

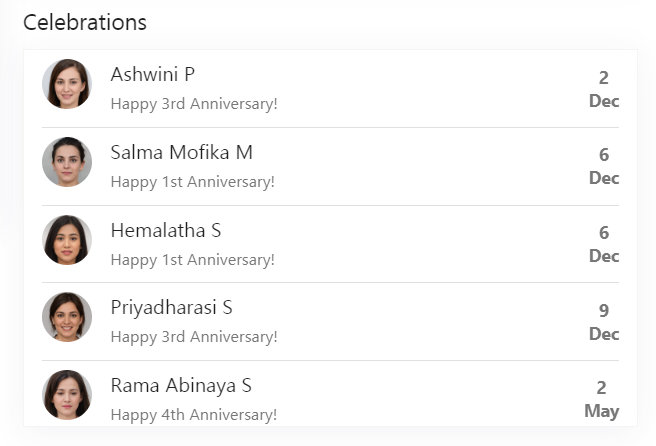

Celebrations

The Celebrations section displays the birthdays and work anniversaries of all the employees.

Upcoming Holidays

The Upcoming Holidays section displays all upcoming holidays for the current year.