If the user’s role has permission to view employee details, then the details will be displayed. When you’re the super admin you can edit the personal information and perform all payroll activities like submitting investment proofs, changing PF contribution rate, Employee PF, ESI contribution and more. Once your employee accepts the invitation, they can set up their account.

The portal consists of:

- Personal Information

- Contact

- Payroll Information

- Bank Details

- PAN, Aadhar, PF, ESI, etc.

- Family Information

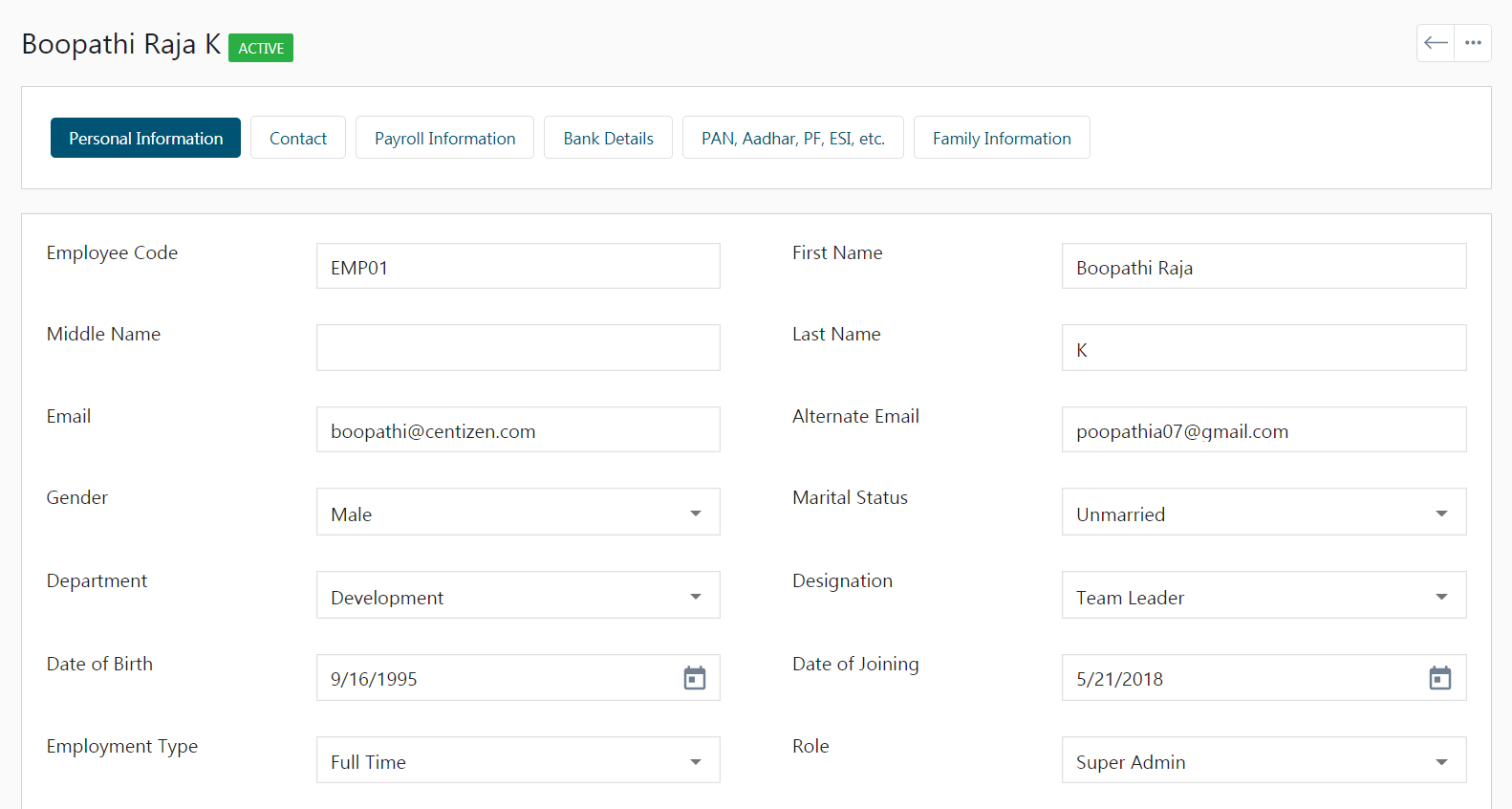

Personal Information

As a super admin or admin, in the personal information tab, you can view and edit the personal details:

- Name: You can add or modify the first name, middle and last name.

- Email: Your email is fetched directly from the database while accepting the invitation sent by the employer for the first time.

- Alternate Email: You can add an alternate email for recovery purposes.

- Gender: Choose your gender from the drop-down box.

- Marital Status: You can choose your marital status as married or unmarried from the drop-down.

- Department: The department varies with organization, so based on your field they can select your department from the drop-down.

- Designation: Based on the working field you can choose the designation.

- Date of Birth: Add your date of birth.

- Date of Joining: Choose your joining date in the organization.

- Employment Type: Select the employee type. For example, full-time, part-time, consultant etc.

- Role: Only the super admin can change the role of your Zenyo Payroll software portals.

- Reporting Manager: You can add the head of your team member.

- Holiday Policy: Organizations have different holiday policies, based on your category and work location you can choose your holiday location.

- Work Location: An organization with multiple branches, needs to segregate its employees. So in the work location as a super admin or admin, you can specify your work location.

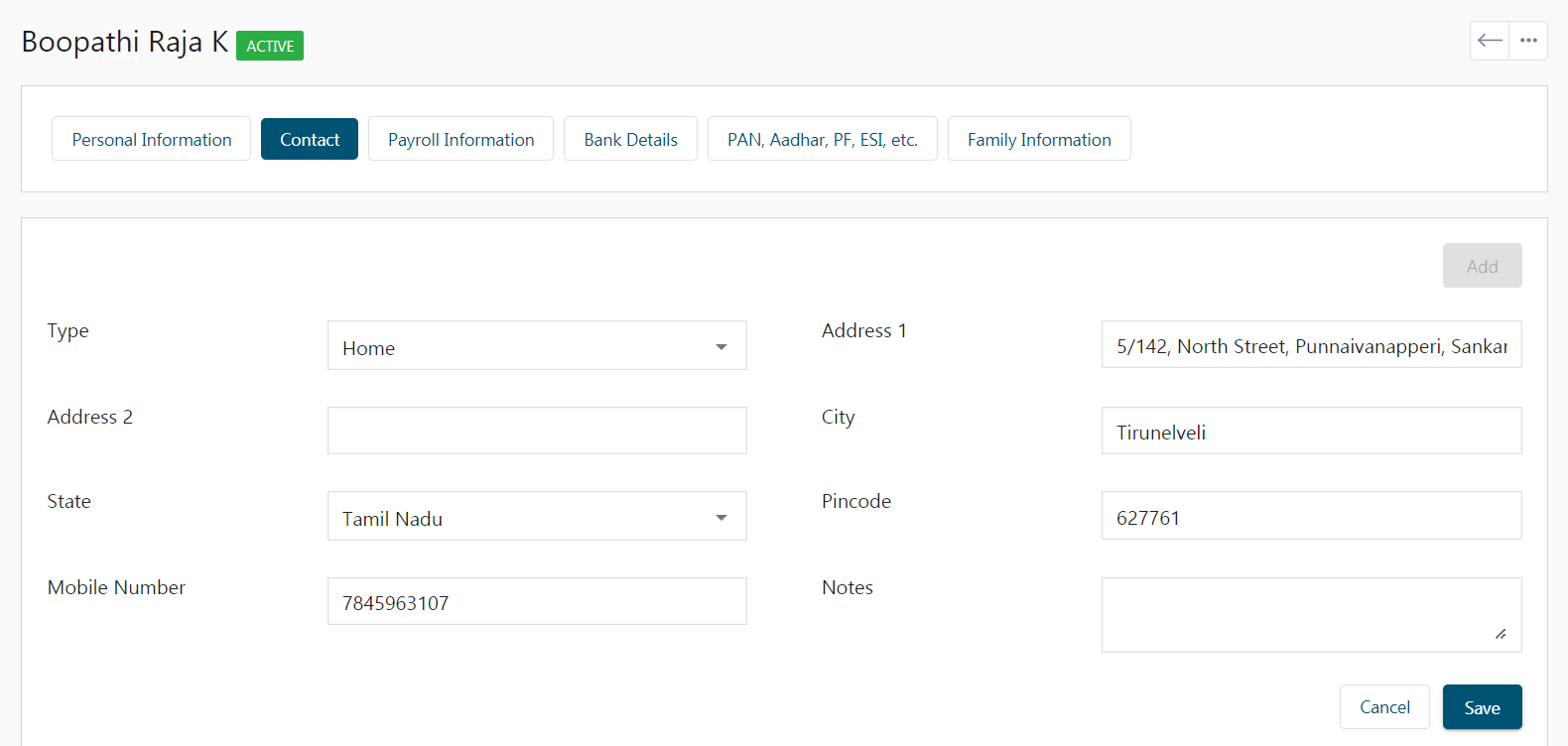

Contact

In the contact tab, you can add your contact address.

- You can add Home, Office, or other addresses by choosing the type.

- Enter your door number, street name, and location.

- Add your City, State, Pincode, and Mobile Number to complete the address.

- Add any landmarks or notes for additional information.

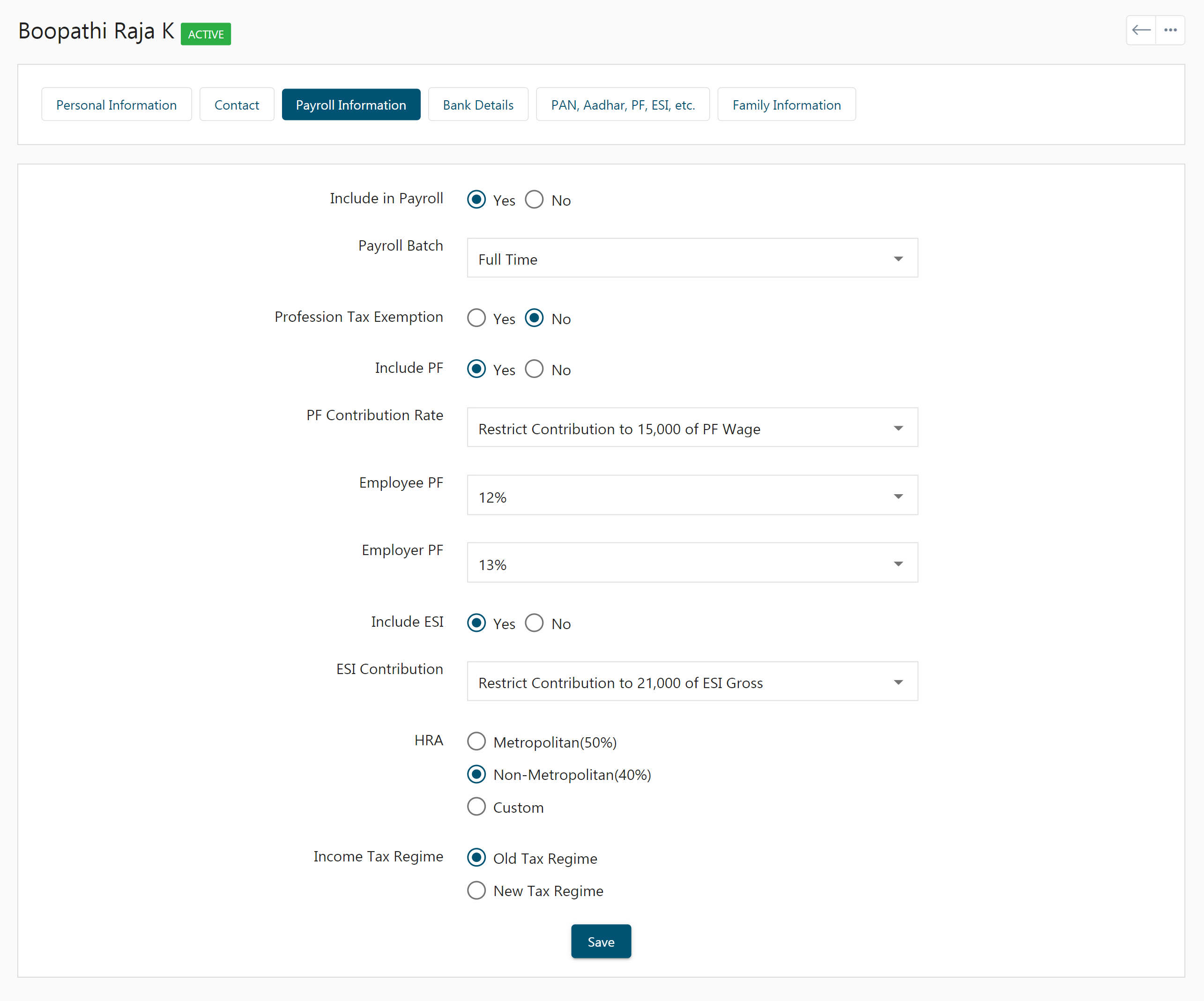

Payroll Information

In the Payroll Information, all this information is mandatory to process the payroll.

- Choose Yes or No in Include in Payroll. Choosing Yes signifies this particular employee will be included in the payroll. If you choose No the employee will be excluded from the payroll.

- Choose your Payroll Batch.

-

Choose whether Profession Tax is to be Exempted.

Exemption in Professional Tax

The below-mentioned individuals need not pay Professional Tax:

- Individuals who run educational institutions that teach classes up to the twelfth standard.

- Individuals in the Central Para Military Force (CPMF).

- An individual who has one child and has undergone a sterilization operation. However, the relevant documents must be submitted.

- Any ex-serviceman who comes under SI No.1 (Schedule)

- Any handicapped individual who has at least a 40% disability. However, the relevant certificate must be submitted.

- Individuals who have a permit for a single three-wheeler or a single taxi to carry goods.

- Deaf, dumb, and blind individuals who are earning a salary.

- Civilian non-combatant and combatant members who are part of the Armed Forces. However, the Army Act must govern the Armed Forces.

- Foreign technicians who have been employed by the state.

- All philanthropic and charitable hospitals that are present in places that come under below taluk level.

- Check Include PF if PF is applicable, then choose the contribution rate, Employee PF and Employer PF.

- Similarly, you have to choose whether you need to contribute to ESI or not. If yes, choose the contribution else just click on no.

- Choose your House Rent Allowance (HRA) from Metropolitan (50%), Non-Metropolitan (40%), or Custom. If you choose custom, kindly mention HRA Percentage.

- Select whether your tax is to be calculated based on Old Tax Regime or New Tax Regime.

- Finally Click Save.

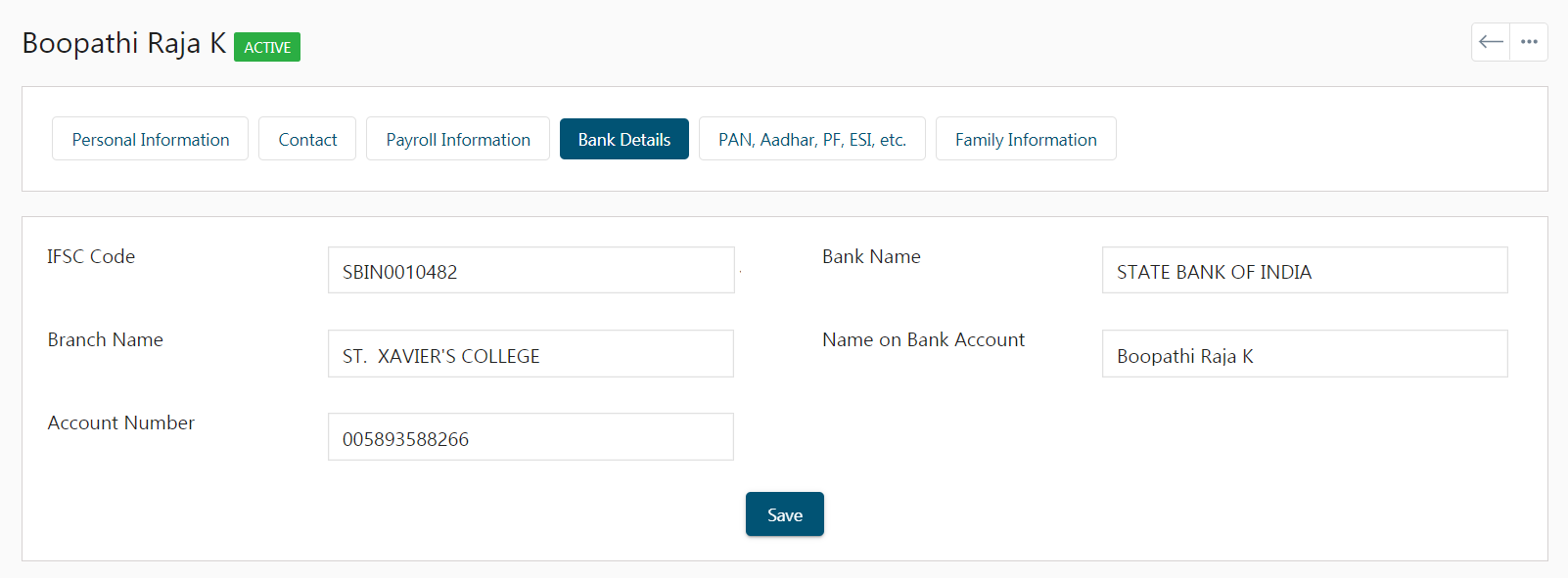

Bank Details

- Enter your bank IFSC Code.

- The IFSC code fetches your bank information such as bank name and branch location (bank location).

- Enter your name on your bank account and account number to credit your salary.

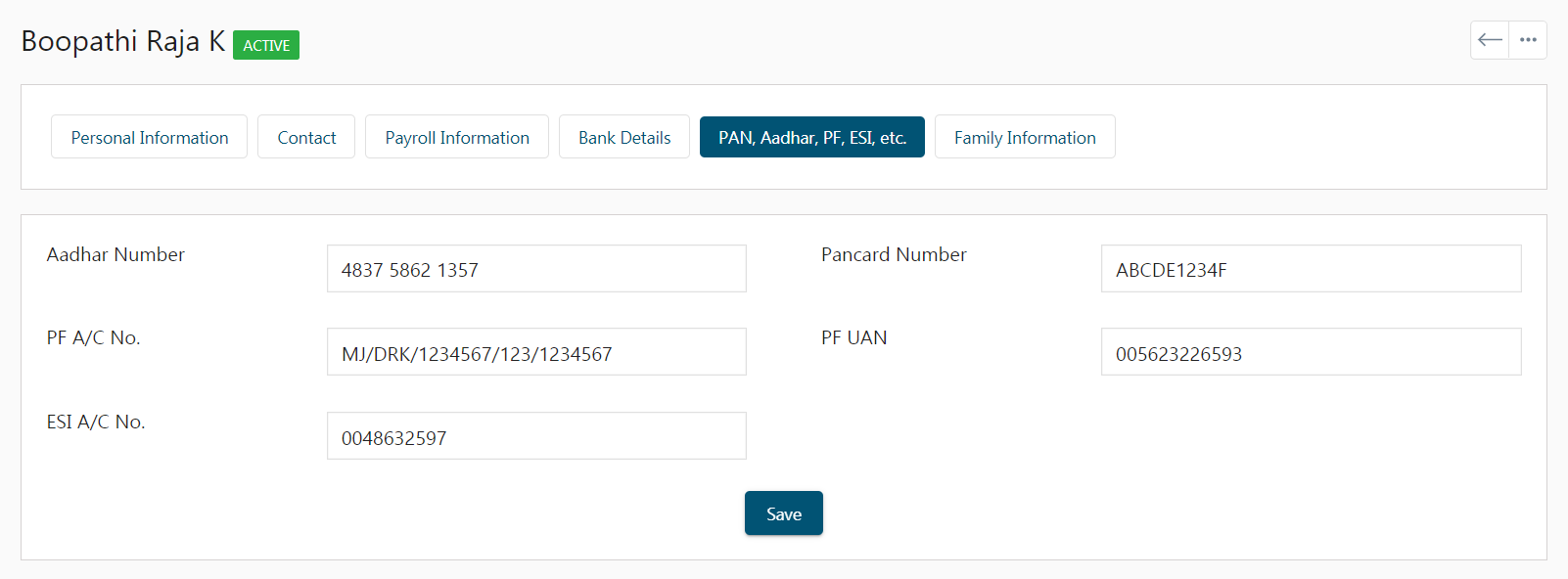

PAN, Aadhar, PF, ESI Details

- Enter your Aadhar number and PAN number.

- Enter your PF Account Number, PF, UAN, and ESI Account number if applicable.

- Then click on the Save button.

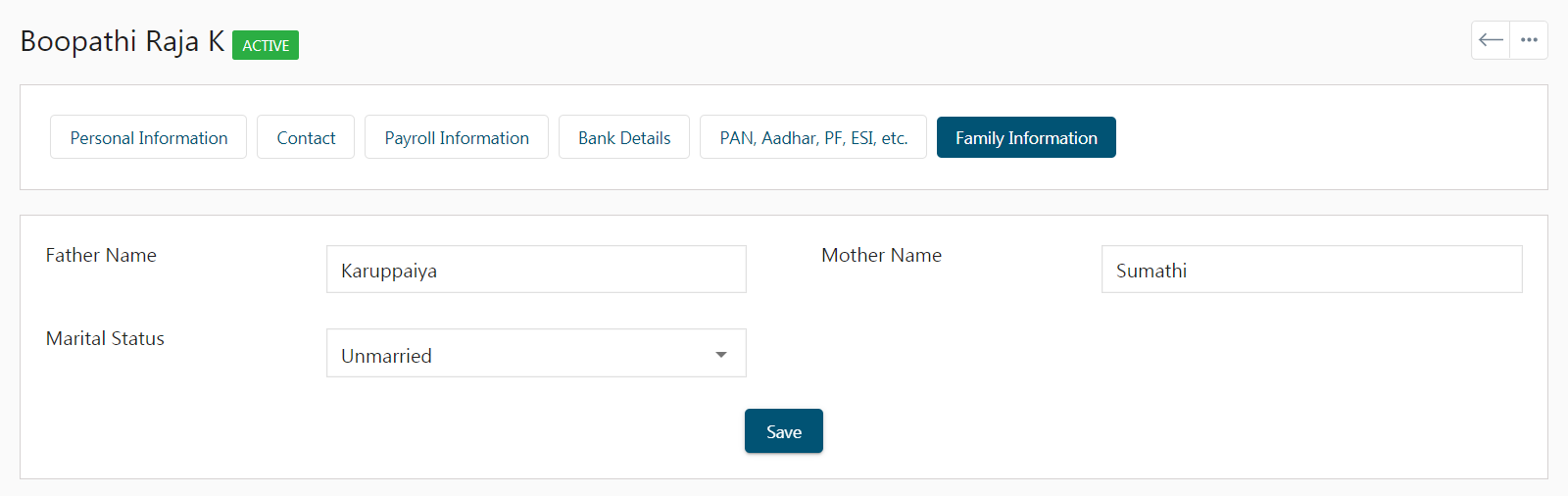

Family Information

- Enter your father’s name, mother’s name, and marital status.

- If you’re married enter your spouse’s name and kid’s information.

- Click Save.